Importing Payroll

Because

of its frequent revisions, Clients & Profits

doesn’t handle payroll accounting directly.

Instead, it works with a payroll program called

CheckMark Payroll by CheckMark Software.

CheckMark is a stand-alone system

that tracks employees, deductions, and other payroll

issues apart from Clients & Profits. Information

about your payroll, however, can be extracted from

CheckMark Payroll on a monthly basis then imported

into Clients & Profits.

Importing payroll eliminates entering payroll records twice, so it saves

time. Your payroll costs are imported, verified, then saved as unposted

journal entries. You can then proof these payroll entries just like other

journal entries, make changes, then post them. Posting updates your payroll

and cash balances on your financial statements.

Since Clients & Profits and

CheckMark Payroll are not actually linked, you’ll

need to make sure your G/L accounts are the same

in both programs. Payroll entries exported from

CheckMark get a G/L account number, which is verified

when the data is imported. If the account number

is wrong for any reason, the journal entry will

be saved into Suspense -- and should be changed

before it is posted.

For

more information on CheckMark Payroll see their web site. For

more information on CheckMark Payroll see their web site.

To export your payroll data from CheckMark Payroll

1 From the CheckMark Payroll program, Choose Reports > Check

Information.

2 Select the correct month.

3 Highlight the payroll checks to be included in this

journal entry.

4 Select Posting Summary.

5 Choose M.Y.O.B. from the text file format pop-up

menu.

6 Click on the Text button

to export the payroll summary data.

7 Name the text file something like 1/98 Payroll then

click OK. This text file, containing your payroll entries,

will be saved to your hard drive. Now it is ready to import

to Clients & Profits X.

8 Quit CheckMark Payroll.

To import your payroll data into Clients & Profits

X

1 Choose Accounting menu > General Ledger

2 Select the Import Payroll button

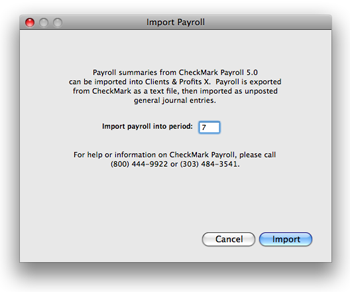

The Import Payroll window opens, prompting you to enter an accounting

period.

3 Enter an accounting period.

The accounting period is used by the payroll entries to update your financial

statements. Your current accounting period is entered automatically,

but can be changed. Any unlocked period can be used.

4 Click Import.

You’ll be prompted to find the payroll text file. Any kind of text

file will appear in the Import dialog box, so be careful to select the

right text file.

You’ll then be prompted to open your payroll text file.

4 Select your payroll text

file, then click OK.

Your payroll entries import one after another (you’ll see the record

count as they’re imported).

If

the text file isn’t tab-delimited, you’ll get an

error message. Payroll text files must be tab-delimited. If

the text file isn’t tab-delimited, you’ll get an

error message. Payroll text files must be tab-delimited.

Once imported, the G/L account number of the entries is verified. If

an account on the payroll entry doesn’t exist, the entry will be

posted to the Suspense account (#999998). You’ll see these entries

on the proof list; they should be fixed before they are posted.

Be

very careful not to import that same payroll text file more

than once. If so, your payroll entries may be posted twice.

For security, trash (or otherwise file away) your payroll

text files once they’ve been successfully posted. Be

very careful not to import that same payroll text file more

than once. If so, your payroll entries may be posted twice.

For security, trash (or otherwise file away) your payroll

text files once they’ve been successfully posted.

Any

payroll entry that has the G/L account of #999998 had an

invalid account, and should be fixed. Don’t post these

entries until they’re correct. Any

payroll entry that has the G/L account of #999998 had an

invalid account, and should be fixed. Don’t post these

entries until they’re correct.

Importing payroll. Accounting

data from payroll checks is exported from

CheckMark as a text file. This file, which

contains the date, account number, and payroll

amount (but not the staff name or salaries),

is imported as unposted journal entries.

Once the data is imported, you can proof

it, make changes, then post the entries.

|

|