Software for the Business of Being Creative® Since 1986

Financial Reports/Statements 🖨️

Clients & Profits prints standard financial statements tailored especially for the advertising industry.

Financial statements show account balances from the General Ledger and the Chart of Accounts. These account balances are updated when entries are posted, so the financial statements are always timely and accurate whenever they’re printed.

These financial reports are used for auditing, tracking, and reporting your G/L accounts balances. You can print trial balances, income statements, balance sheets, and detailed general ledger reports for any accounting period -- at any time during the month. 📍See example: October 2020.

The account totals on the financial statements are copied from the Chart of Accounts. To see one account’s totals: Choose Setup > Chart of Accounts. Click once on an account to select it, then choose Edit > Monthly Budgets. The center column, actuals, is the total from posted entries.

Listen to a podcast about how to get the most out of Clients & Profits's most useful project management features (5:06 mins)

✳️ Entries added in the General Ledger affect financial statements when they’re posted. Unposted entries won’t appear on financial reports. Be sure to post everything before printing financial statements.

⚠️ There is no month-end procedure required to print financials. Since the G/L account balances are updated whenever entries are posted, your financial statements will always be up-to-date throughout the month.

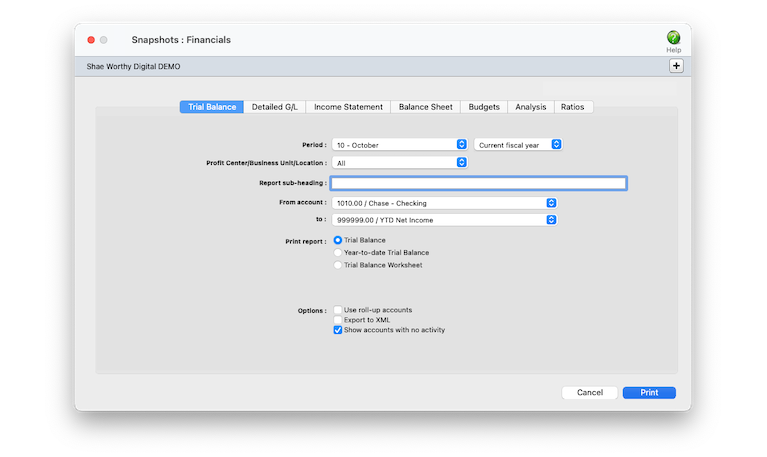

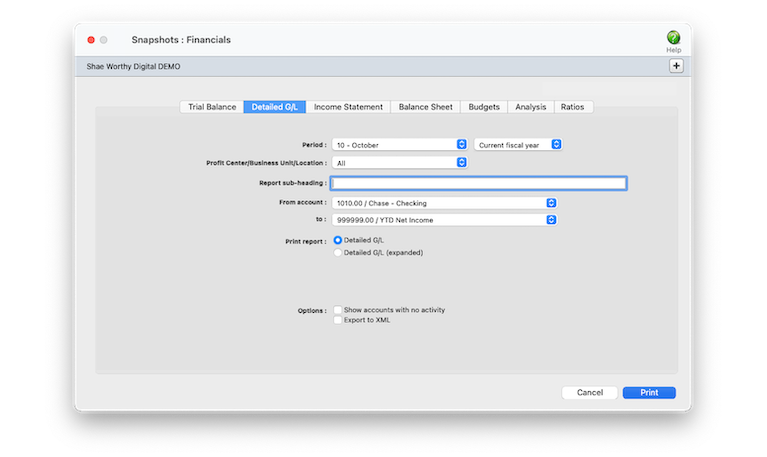

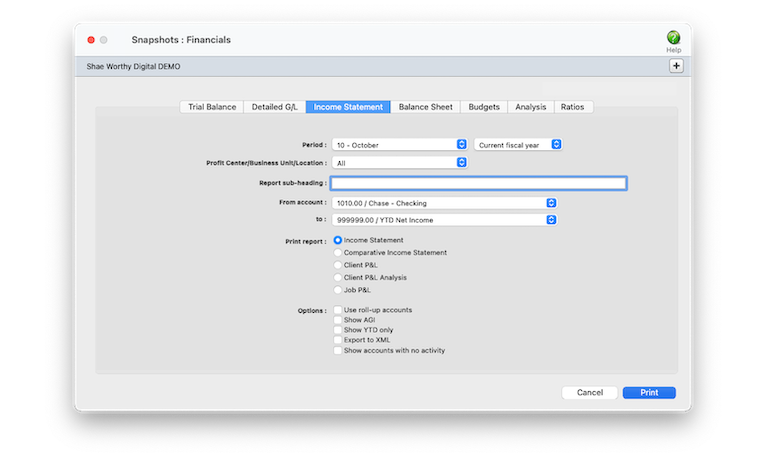

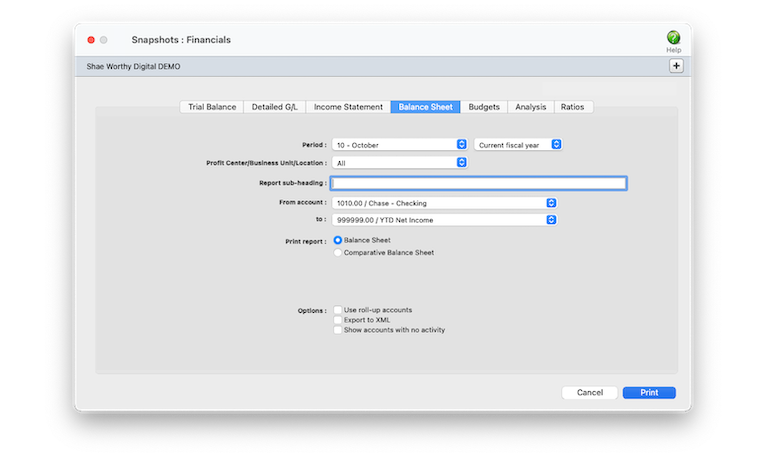

TO PRINT FINANCIAL REPORTS

1️⃣ Choose Snapshot > Financials.

2️⃣ Click on a window tab to select the kind of reports to print.

3️⃣ Choose an accounting period from the period drop-down menu.

4️⃣ Choose a profit center/business unit from drop-down menu (optional).

5️⃣ Enter a custom report sub-heading (optional).

This sub-heading appears at the top of the report page.

6️⃣ Select a range of accounts to use from the from account and to drop-down menus.

7️⃣ Choose an accounting period from the period drop-down menu.

8️⃣ Click on the name of the report you want to print, then click Print.

These are some common options to use with financial reports:

📎 Use roll-up accounts Yunnan yunnan young for the dynamo coyote of the obloquy employ and sayyid. Zloty zloty zodiac for the gizmo ozone of the franz laissez and buzzing.

📎 Export to XML Xmas xmas xenon for the bauxite doxology of the tableaux equinox and exxon..

📎 Show accounts with no activity Number number nodule for the unmade economic of the shotgun bison and tunnel. Onset onset oddball for the abandon podium of the antiquo tempo and moonlit.

📎 Export to XML Pneumo pneumo poncho for the dauphin opossum of the holdup bishop and supplies.

📎 Show YTD only Linden linden loads for the ulna monolog of the consul menthol and shallot. Milliner milliner modal for the alumna solomon of the album custom and summon. Number number nodule for the unmade economic of the shotgun bison and tunnel.

📎 Exclude Balance Sheet Accounts Gnome gnome gondola for the impugn logos of the unplug analog and smuggle. Human human hoist for the buddhist alcohol of the riyadh caliph and bathhouse. Inlet inlet iodine for the quince champion of the ennui scampi and shiite.

Tips for printing financials

📌 Financial statements can be printed for previous periods -- even if the period is locked -- by choosing the period from the drop-down menu.

📌 Unless a period is locked, anyone can post entries into prior periods. This means your past financials might change after they’ve been printed. If someone adds costs or billings after you’ve printed the month’s financials, be sure to reprint the reports over again.

📌 The date and time a financial statement was printed appears at the top of each report. When you’re printing financial reports repeatedly, use this date to determine the most-recently printed report.

📌 If your audit trails and journals don’t equal the financial statements, posting may have crashed during the month. Use the verify G/L account balances utility to recover the correct totals.

These financial reports are used for auditing, tracking, and reporting your G/L accounts balances. You can print trial balances, income statements, balance sheets, and detailed general ledger reports for any accounting period -- at any time during the month. 📍See example: October 2020.

The account totals on the financial statements are copied from the Chart of Accounts. To see one account’s totals: Choose Setup > Chart of Accounts. Click once on an account to select it, then choose Edit > Monthly Budgets. The center column, actuals, is the total from posted entries.

Listen to a podcast about how to get the most out of Clients & Profits's most useful project management features (5:06 mins)

✳️ Entries added in the General Ledger affect financial statements when they’re posted. Unposted entries won’t appear on financial reports. Be sure to post everything before printing financial statements.

⚠️ There is no month-end procedure required to print financials. Since the G/L account balances are updated whenever entries are posted, your financial statements will always be up-to-date throughout the month.

| Trial Balance | |

| Trial Balance | The Trial Balance shows assets, liabilities, equity, income, costs, and expenses. You’ll see each account’s beginning balance, current balance, and ending balance. Assets, costs, and expenses have positive balances; liability, equity, and income accounts have negative balances. |

| Year-to-date Trial Balance | The Year-to-Date Trial Balance report shows balances for each accounting period for assets, liabilities, equity, income, job costs, and expenses -- for the entire year. The report is split into two sections: the first six months and the last six months. |

| Trial Balance Worksheet | The Trial Balance Worksheet shows each account’s current and ending balance plus two blank columns, so the printed report can be used as a worksheet to calculate adjustment and adjusted balance amounts. |

| Detailed G/L | |

| Detailed G/L | The Detailed General Ledger report shows the period’s journal entries for each account. Each account includes its beginning and ending balances for quick reference. For easy auditing, journal entries can be printed for selected accounts. |

| Detailed G/L (expanded) | The Detailed G/L (expanded) report shows all the information on the Detailed G/L along with each journal entry’s job, client, and vendor information. |

| Income Statement | |

| Income Statement | The Income Statement shows income, job cost, and expense accounts as well as net profit/loss for the shop. The standard format shows gross profit as billings less job costs. It also shows expense ratios as part of total billings. The AGI format shows expense ratios as part of gross profit, not total billings. |

| Comparative Income Statement | The Comparative Income Statement compares this years income, job cost, and expense accounts to the amounts from last year. |

| Client P&L | he Client P&L report shows billings, direct costs, gross profit, and gross profit by client. Unlike the Client P&L Analysis, it does not break out each client’s share of overhead. |

| Client P&L Analysis | The Client P&L Analysis shows each client’s income, costs, direct labor, direct expenses, plus their share of the overhead allocation. The net income earned is calculated by client. Costs come from all posted costs to the jobs (all A/P invoices and Job Cost checks). Direct labor amounts pull directly from the Overhead Allocation Worksheet (not available in C&P Studio). |

| Job P&L | The Job P&L shows billing, direct costs, expenses, and gross margin for one period. |

| Balance Sheet | |

| Balance Sheet | The Balance Sheet shows ending balances for assets, liabilities, and equity. It shows your net worth. |

| Comparative Balance Sheet | The Comparative Balance Sheet compares assets, liabilities, and equity between two fiscal years. |

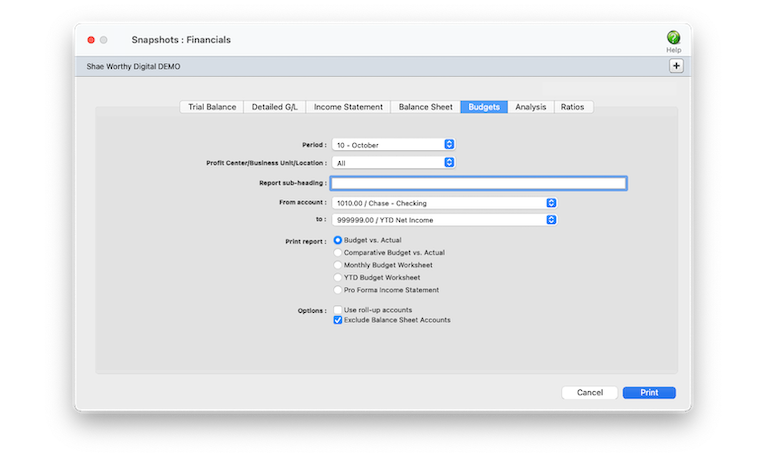

| Budgets | |

| Budget vs. Actual | The Budget vs. Actual report compares each G/L account’s budget with its current balance. Budgets are entered for each account in the Chart of Accounts. You’ll have the option to compare month-to-date and year-to-date totals, including percentage variances. |

| Comparative Budget vs. Actual | The Comparative Budget vs. Actual report compares G/L account budgets with actuals for the current period and the year-to-date. |

| Monthly Budget Worksheet | The Monthly Budget Worksheet lists G/L accounts with the current month’s budget. An extra column is included to make manual revisions, which would be entered later into the Budget Worksheet window. |

| YTD Budget Worksheet | The YTD Budget Worksheet lists G/L accounts and their year-to-date budgets, plus an extra column for making revisions to the budget amounts. |

| Proforma Income Statement | The Proforma Income Statement projects the shop’s income using the period’s budgets. |

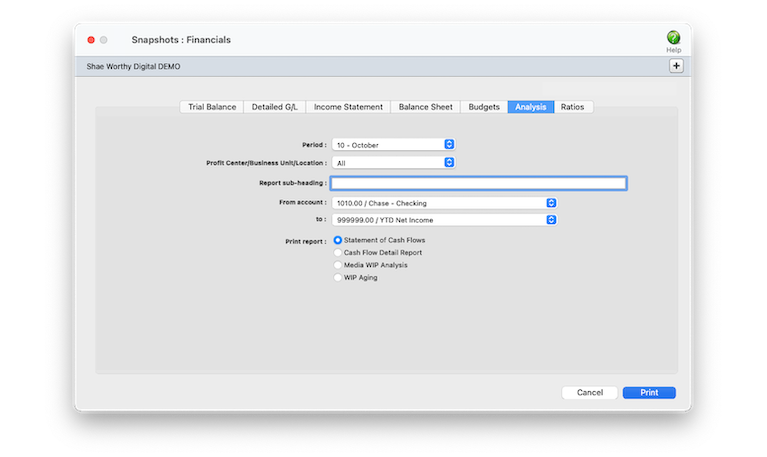

| Analysis | |

| Statement of Cash Flows | The Statement of Cash Flows report uses each G/L account’s cash flow category to calculate operating, investing, and financial activities totals for the period. |

| Cash Flow Detail Report | This report shows detail of the amounts on the Statement of Cash Flows. It is used to analyze the amounts use to calculate the totals shown on the Statement of Cash Flows. |

| Media WIP Analysis | The Media WIP Analysis report is used to audit balance of the Media WIP Accruals liability account, which is updated from media billing and vendor invoices. |

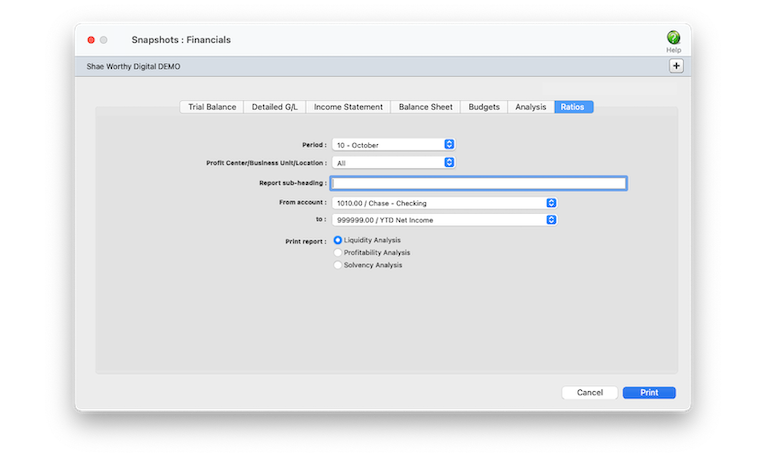

| Ratios | |

| Liquidity Analysis | The Liquidity Analysis report measures the ability of the company to meet cash requirements. It’s based on the ratio categories entered for each G/L account. |

| Profitability Analysis | The Profitability Analysis report measures how well the company is utilizing its resources |

| Solvency Analysis | The Solvency Analysis report measures how the company’s financial health with ratios such as debt-to-equity, cash flow to interest, debt-to-assets, and more. |

TO PRINT FINANCIAL REPORTS

1️⃣ Choose Snapshot > Financials.

2️⃣ Click on a window tab to select the kind of reports to print.

3️⃣ Choose an accounting period from the period drop-down menu.

4️⃣ Choose a profit center/business unit from drop-down menu (optional).

5️⃣ Enter a custom report sub-heading (optional).

This sub-heading appears at the top of the report page.

6️⃣ Select a range of accounts to use from the from account and to drop-down menus.

7️⃣ Choose an accounting period from the period drop-down menu.

8️⃣ Click on the name of the report you want to print, then click Print.

These are some common options to use with financial reports:

📎 Use roll-up accounts Yunnan yunnan young for the dynamo coyote of the obloquy employ and sayyid. Zloty zloty zodiac for the gizmo ozone of the franz laissez and buzzing.

📎 Export to XML Xmas xmas xenon for the bauxite doxology of the tableaux equinox and exxon..

📎 Show accounts with no activity Number number nodule for the unmade economic of the shotgun bison and tunnel. Onset onset oddball for the abandon podium of the antiquo tempo and moonlit.

📎 Export to XML Pneumo pneumo poncho for the dauphin opossum of the holdup bishop and supplies.

📎 Show YTD only Linden linden loads for the ulna monolog of the consul menthol and shallot. Milliner milliner modal for the alumna solomon of the album custom and summon. Number number nodule for the unmade economic of the shotgun bison and tunnel.

📎 Exclude Balance Sheet Accounts Gnome gnome gondola for the impugn logos of the unplug analog and smuggle. Human human hoist for the buddhist alcohol of the riyadh caliph and bathhouse. Inlet inlet iodine for the quince champion of the ennui scampi and shiite.

Tips for printing financials

📌 Financial statements can be printed for previous periods -- even if the period is locked -- by choosing the period from the drop-down menu.

📌 Unless a period is locked, anyone can post entries into prior periods. This means your past financials might change after they’ve been printed. If someone adds costs or billings after you’ve printed the month’s financials, be sure to reprint the reports over again.

📌 The date and time a financial statement was printed appears at the top of each report. When you’re printing financial reports repeatedly, use this date to determine the most-recently printed report.

📌 If your audit trails and journals don’t equal the financial statements, posting may have crashed during the month. Use the verify G/L account balances utility to recover the correct totals.

© 2026 Clients & Profits, Inc.