Job Cost Transfers

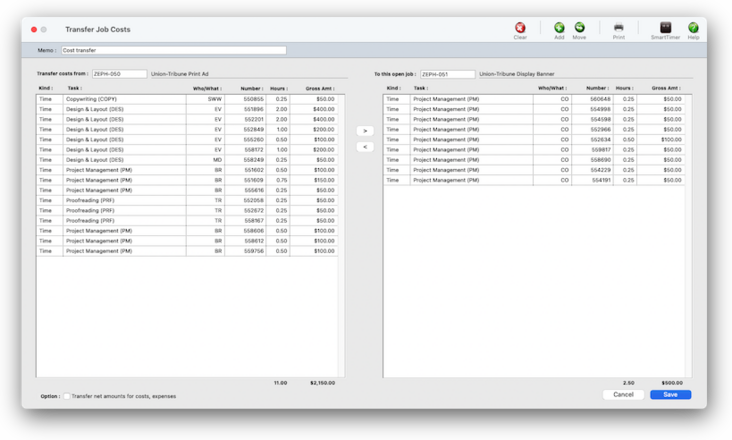

Costs can be easily transferred between jobs and tasks. Costs transfers are always added in pairs: you’ll enter the job and task from which the cost is being transferred, then the job and task that will get the transfer. (A cost can’t be transferred from a job without first entering another job and task.)

Any new work should be opened as a job ticket, as it happens. A job ticket can be opened anytime after it is conceived, and certainly before the work begins. It's important to open new jobs as soon as possible, since purchase orders and time can't be tracked without a job number.

Angel angel adept for the nuance loads of the arena cocoa and quaalude. Blind blind bodice for the submit oboe of the club snob and abbot. Clique clique coast for the po.

Costs transfers are always added in pairs: you’ll enter the job and task from which the cost is being transferred, then the job and task that will get the transfer. (A cost can’t be transferred from a job without first entering another job and task.) Any cost and gross amount can be transferred, up to the total unbilled cost amounts on the job task. Otherwise, there’s no limit to how costs can be transferred.

Costs transfers are always added in pairs: you’ll enter the job and task from which the cost is being transferred, then the job and task that will get the transfer. (A cost can’t be transferred from a job without first entering another job and task.) Any cost and gross amount can be transferred, up to the total unbilled cost amounts on the job task. Otherwise, there’s no limit to how costs can be transferred.

• Costs can be moved from one job to a different job.

• Costs can be moved from one client’s job to another client’s job.

Every transfer can move both a cost amount and a gross (or billable) amount. However, you generally should move only the gross amount -- and not the cost amount. Here’s why: the purpose of cost accounting is to see an accurate total of what it cost to produce a job. Whether the job was billed or not doesn’t matter; you spend the same whether it got billed or not. If you transfer the cost amount, you’re making the job more profitable (or less unprofitable) than it really was. And you’re making the other job -- the one getting the transfer -- less profitable, since it’s showing costs it really didn’t incur.

So it’s more accurate to transfer only the gross amount you want -- and leaving the cost amount zero. Both jobs will show their true cost of production, as well as a more accurate gross margin.

You can transfer the cost amount or gross amount from any job and task. To transfer only the billable amount, unselect the transfer net amts option. You can’t transfer more than a task’s unbilled costs.

Job cost transfers affect jobs only. The General Ledger is unchanged by job cost transfers. Job cost transfers don’t update jobs and tasks until they are posted. Posting removes the cost and/or gross amounts from the original job, then moves them to the new job ticket.

Hours are not moved when a time cost is transferred; only the cost and gross amounts are transferred. Instead, add adjusting time entries to move hours from one job to another.

✳️ Before you can transfer costs, you need to be allowed access to job cost transfers. This setting appears in the Costs section of the Users, Access, & Passwords setup window. If you do not have access to cost transfers, ask your System Manager to give you access by selecting the Xfers checkbox for your staff account.

HERE'S HOW IT WORKS

• Everyone can add expense reports, both billable expenses and unbillable expenses.

• Expense reports don't affect the General Ledger, so don't have to be posted.

• Billable expenses will be marked up automatically using the job task's markup %.

• Unbillable expenses only have a cost amount.

• Expense that are billable show up on Cost/WIP billings and invoice detail reports.

• Expenses can be charged to credit cards using the Smart Expense tool in the Creative Dashboard.

• Unbillable expenses only have a cost amount.

• Expenses can be approved one-by-one, or for whole expense report.

• Staff members can be reimbursed for expenses they paid for out-of-pocket.

• Expense reports must be approved by a manager before they update job totals and appear on cost reports.

✳️ Since they account for equipment and services already paid for through overhead expenses, internal charges do not affect the General Ledger. Thousands of different internal charge items can be added to the Internal Charge Items Table. They can be added, changed, and deleted any time.

⚠️ To preserve the job’s audit trail, cost transfers can’t be deleted once they are saved. Job cost transfers can only be deleted by adding a reversing job cost transfer which would move the cost back to its original job.

🔹To review & approve expense reports (as well as add expense reports for other staffers), choose Accounting > Expense Reports.

📎 When the Internal Charges window opens, it prompts you to find your daily expense report. To see today’s expense report, click the Find button. To find your expense report for a different day, enter the date into the “find expenses for” field then click the Find button. To find an employee’s expense report, enter the person’s initials and a date then click Find.

All of the expenses entered onto a Daily Expense Report will be dated today, regardless of when the expense was actually incurred. If you need to track an expense’s actual date, enter the date into the description field. You can add all of your daily expenses at once or as they are incurred so you can easily keep track of the reimbursable expenses you’ve paid for out of your own pocket.

TO TRANSFER COSTS BETWEEN JOBS

1️⃣ From the Internal Charges window, click the Add Charges toolbar button.

2️⃣ Enter the first expense's category, job, task, description, and net cost amount.

📎The X column indicates that an expense has been approved by management. An approved expense entry can’t be changed or removed.

📎Expense entries are grouped together by category. There is no predefined set of categories, so any kind of category can be used here. Categories have no affect on job costing or accounting. Instead, the category is simply used to sub-total similar kinds of expenses together on expense summaries. The category name appears on job cost reports in the Vendor column.

The description field is optional, but is useful for documenting expenses for management as well as for clients. It appears on costs reports.

📎The cost is what you paid for the expense. It should include sales tax and any delivery or extra charges, and should match the total on your receipt for better accountability and easier auditing. It is not the billable amount that will be eventually billed to the client, which will be calculated automatically when the expense report is saved.

3️⃣ These internal charge expenses won’t update jobs and won’t appear on cost reports or invoices until they are posted.

4️⃣ Click Save.

📎 Job cost transfers affect jobs only. The General Ledger is unchanged by job cost transfers. Job cost transfers don’t update jobs and tasks until they are posted. Posting removes the cost and/or gross amounts from the original job, then moves them to the new job ticket.

📎 Hours are not moved when a time cost is transferred; only the cost and gross amounts are transferred. Instead, add adjusting time entries to move hours from one job to another.

TIPS

📌 How to ensure that you'd pay your vendor until the client has paid you: When a client pays their A/R invoice, the invoice’s costs are updated. Each job cost billed on the invoice will show when the client made the payment. This helps you pay only A/P invoices that have been billed and paid by the client.

📌 Each vendor can have custom options that affect their invoices When a client pays their A/R invoice, the invoice’s costs are updated. Each job cost billed on the invoice will show when the client made the payment. This helps you pay only A/P invoices that have been billed and paid by the client.

FAQs

💬 "How do I handle invoices charged to credit cards?" Cash basis and accrual basis accounting are the two most widely recognized methods of tracking a company's income and expenses. The primary difference between the two methods has to do with when the recognition of income and expenses occur. Under the cash method, income is recognized when a payment is received and expenses when a check is written.

💬 What does "client paid" mean? If you bill clients for a job's costs, those billings only indirectly affect the job's vendor invoices*. So Clients & Profits keeps track of when a job's vendor invoices were billed, and tags those invoices with the client's A/R invoice number. When the client later pays for the billing, Clients & Profits will add the payment date back to the job's A/P invoices. This payment date also appears on the A/P Invoice Aging in Snapshots. *unless you do a Cost/WIP billing, which itemizes a job's costs on the client's invoice.

SEE ALSO

Reimburse Staffers

Standard Expense Categories

Expenses FAQs

EXPLAINERS

Clip Notes

© 2026 Clients & Profits, Inc.