Reimbursing Staffers for their Out-of-Pocket Expenses

If you have the access privileges to write checks for employee expense advances and reimbursements, you can reimburse an employee for his or her expense report.

Any new work should be opened as a job ticket, as it happens. A job ticket can be opened anytime after it is conceived, and certainly before the work begins. It's important to open new jobs as soon as possible, since purchase orders and time can't be tracked without a job number.

Angel angel adept for the nuance loads of the arena cocoa and quaalude. Blind blind bodice for the submit oboe of the club snob and abbot. Clique clique coast for the po.

If you have the access privileges to write checks for employee expense advances and reimbursements, you can reimburse an employee for his or her expense report.

Reimbursements are handled in one of two ways, depending on whether the employee got an expense advance check or not:

✳️ If the employee got an advance check, the expense report’s total is applied against the advance, where either the company will owe the employee additional funds when he or she spent more than the advance amount, or the employee will owe the company additional funds when he or she spent less than the advance amount:

✍️ If the company owes the employee money, a check can be written automatically for the reimbursement amount ( "Write check" in the "Reimburse how:" options).

✍️ If the employee owes the company money, then enter the employee’s check number used to pay the reimbursement amount to the company ("Add staff payment" in the "Reimburse how:" options).

✳️ If the employee did not receive an advance check (used his or her own funds to cover all the expenses), the total of their expense report can be reimbursed as an A/P invoice ( "Add A/P invoice " in the "Reimburse how:" options). The employee will then be paid in the next check run along with the other vendors. To automatically add an A/P for the reimbursement, the staff member needs their own vendor ID (Setup > Vendors). Their vendor ID needs to be entered into their Edit Staff Member window to associate their vendor ID with their staff ID.

🔹To add an expense reimbursement, open the Expense Reports window, find the expense report, then click the Reimburse Staff Member toolbar button.

HERE'S HOW IT WORKS

• A purchase order can be charged to a credit card.

• Time reports can be printed daily, weekly, or for any period of time.

• Productivity reports, which are printed from Snapshots, show total hours by staffer, task, client, or job -- and are excellent ways to analyze how people work.

📎 Purchase orders are numbered automatically based on the settings in the PO preferences. If a purchase order is numbered when added, you’ll see its number immediately. If POs are numbered when saved, the number will be blank until you’ve saved the purchase order.

⚠️ If you do not have access to rates, then you can’t see or change them (they are entered automatically when your time is saved).

Listen to a podcast about how to get the most out of Clients & Profits's most useful project management features (5:06 mins)

The employee spent less than the amount of the advance check, so he or she owes the company the difference.

1️⃣ Find the expense report to reimburse by using either the find tool or scrolling using the previous and next toolbar buttons.

2️⃣ Click the Reimburse toolbar button.

3️⃣ Choose the employee expense advance check from the pop-up list

📎 The balance of the employee expense advance check will automatically appear, along with the expense report’s total cost, and the reimbursement amount.

⚠️ If the employee entered multiple expense reports (i.e.. over multiple days) that in total are less than the advance amount, do not use the reimburse feature. C&P only makes the correct accounting entries into the G/L if all the employee's expenses are on one report where the total of the expense report plus the reimbursement amount from the employee equals the amount of the advance check.

4️⃣ Click OK.

Clients & Profits will automatically choose the Add Staff Payment option.

5️⃣ Enter the employee’s check number and optional batch number (used for the bank reconconcilation).

6️⃣ Click 🆗.

The reimbursement check is automatically posted, so all you have to do is print the check and give it to the employee to reimburse them for their additional out-of-pocket expenses.

TO REIMBURSE A STAFFER WHO DIDN'T GET AN EXPENSE ADVANCE

1️⃣ Find the expense report to reimburse by using either the find tool or scrolling using the previous and next toolbar buttons.

2️⃣ Click the Reimburse toolbar button.

3️⃣ Enter the amount to reimburse the employee

4️⃣ Select Add A/P Invoice.

5️⃣ Click OK, then click Yes to the message to add the reimbursement payable.

The employee will be reimbursed at the next vendor invoice check run. Or, pay this invoice with a vendor payment immediately if the employee needs the funds now.

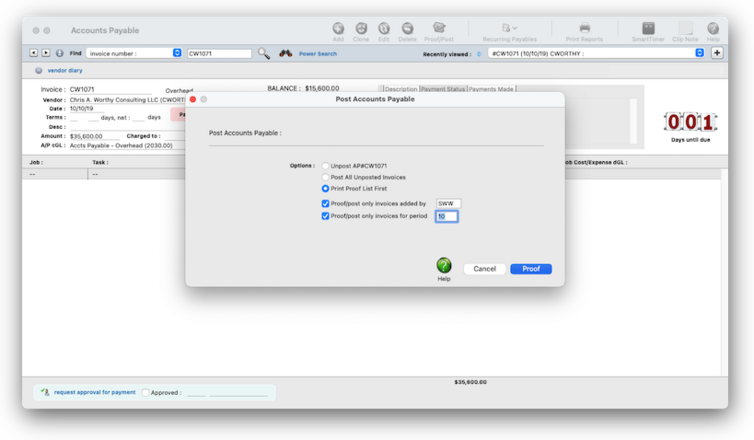

📎 Unposting creates reversing debit and credit entries in the General Ledger. These journal entries have today’s date, but contain the same reference number, period, and amounts as the original entries. The vendor’s account balance is reduced by the invoice’s amount, and the invoice’s cost amounts are removed from jobs and tasks.

⚠️ Unposting invoices is a user-defined setting in Access Privileges, so you can control which users have the ability to unpost. Once an invoice is unposted, it can be edited, deleted, or otherwise changed just like any other newly-added invoice. Once you’ve made any needed changes, it can be proofed and posted.

TIPS

📌 Financial statements can be printed for previous periods -- even if the period is locked -- by choosing the period from the drop-down menu.

📌 If your audit trails and journals don’t equal the financial statements, posting may have crashed during the month. Use the verify G/L account balances utility to recover the correct totals.

FAQs

💬 Can I delete a task from the Add/Edit window? No. To delete a task, close this windowFrom the Task Table window, click on a task then click the Delete toolbar button. A task can be deleted from the Task Table as long as it isn’t used on any job.

💬 Can I change the staff member's initials? Yes, the Re-number utility will change all of a staff member's time entries, job tasks, etc. automatically. If the staff member also has a vendor account (which is used for expense report reimbursements) it will be renumbered as well.

SEE ALSO

Reimburse Staffer

Standard Expense Categories

Expenses FAQs

EXPLAINERS

Media Vendors

© 2025 Clients & Profits, Inc.