Expense Reports

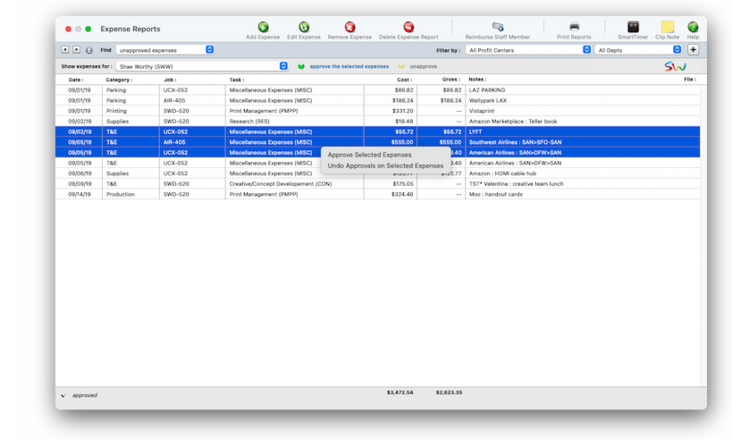

Users with access to expenses can see and approve employee daily expense reports from the Expense Reports window.

Any new work should be opened as a job ticket, as it happens. A job ticket can be opened anytime after it is conceived, and certainly before the work begins. It's important to open new jobs as soon as possible, since purchase orders and time can't be tracked without a job number.

Angel angel adept for the nuance loads of the arena cocoa and quaalude. Blind blind bodice for the submit oboe of the club snob and abbot. Clique clique coast for the po.

The Expense Reports window lets you find and review daily expense reports entered by the company’s employees. The window lets you see your own expense reports as well as those entered by other staff members. For each daily expense report you’ll see its expense entries, including category, job, task, cost amount, and description.

Expense reports are simply a collection of individual expense entries for a staff member. Anyone can add expense reports. However, expense reports must be approved by management. Any user with the cost access privileges to approve expense reports can approve them, which posts the cost amounts to jobs and tasks and prepare the expense report for reimbursement.

As an option, once an expense report is approved it can be reimbursed. Reimbursing an expense report is handled in one of two ways, depending on whether the employee had an expense advance (see below).

When the Expense Reports window opens, it prompts you to find your daily expense report. To see today’s expense report, click the Find button. To find your expense report for a different day, enter the date into the “find expenses for” field then click the Find button. To find an employee’s expense report, enter the person’s initials and a date then click Find.

HERE'S HOW IT WORKS

• Everyone can add expense reports, both billable expenses and unbillable expenses.

• Expense reports don't affect the General Ledger, so don't have to be posted.

• Billable expenses will be marked up automatically using the job task's markup %.

• Unbillable expenses only have a cost amount.

• Expense that are billable show up on Cost/WIP billings and invoice detail reports.

• Expenses can be charged to credit cards using the Smart Expense tool in the Creative Dashboard.

• Expenses charged to credit cards are tagged with the credit card icon.

• Unbillable expenses only have a cost amount.

• Expenses can be approved one-by-one, or for whole expense report.

• Staff members can be reimbursed for expenses they paid for out-of-pocket.

• Expense reports must be approved by a manager before they update job totals and appear on cost reports.

✳️ The My Daily Expense Reports window records all of your reimbursable out-of-pocket expenses, like tolls, client lunches, cab fares, or tips. Specific information is entered for each expense, including category, the job number and task, a description, and cost. The category is completely user-defined, and the description for each expense can be as long as needed to explain how the money was spent.

✳️ Expense reports must be approved. Expense reports can only be approved as a whole. This means clicking the Approve button will approve all of the entries on the expense report. Since its an all-or-nothing function, don’t approve an expense report unless its completely acceptable.

EXPLAIN PERMISSIONS If you do not have access to rates, then you can’t see or change them (they are entered automatically when your time is saved).

🔹To review & approve expense reports (as well as add expense reports for other staffers), choose Accounting > Expense Reports.

When the Clients window is opened, the last-used client is displayed automatically.

1️⃣ Choose My > My Clients.

The Clients window opens, displaying the previously viewed client.

2️⃣ Enter a client number in the Find Number field, then click the magnifying glass icon.

3️⃣ Choose My > My Clients.

The Clients window opens, displaying the previously viewed client.

4️⃣ Enter a client number in the Find Number field, then click 🔎 icon.

5️⃣ Choose My > My Clients.

The Clients window opens, displaying the previously viewed client.

6️⃣ Click Save.

You can find clients by organization name, cost center, or by sequence (i.e., the order in which clients were added). Click the previous and next buttons to browse clients sequentially. You can alternately view a client by choosing it from the Show drop-down menu.

1️⃣ From the Expense Reports window, click the Add toolbar button.

2️⃣ Enter the first expense's category, job, task, description, and net cost amount.

The X column indicates that an expense has been approved by management. An approved expense entry can’t be changed or removed.

Expense entries are grouped together by category. There is no predefined set of categories, so any kind of category can be used here. Categories have no affect on job costing or accounting. Instead, the category is simply used to sub-total similar kinds of expenses together on expense summaries. The category name appears on job cost reports in the Vendor column.

The description field is optional, but is useful for documenting expenses for management as well as for clients. It appears on costs reports.

The cost is what you paid for the expense. It should include sales tax and any delivery or extra charges, and should match the total on your receipt for better accountability and easier auditing. It is not the billable amount that will be eventually billed to the client, which will be calculated automatically when the expense report is saved.

3️⃣ Repeat step 2 for any other expense.

4️⃣ Click Save.

2️⃣ Select one or more expense entries.

3️⃣ Click the Remove toolbar button, or click the ❌ icon button.

1️⃣ From the Expense Reports window, find the expense report you want to delete entirely.

2️⃣ Click the Delete toolbar button (or choose Edit > Delete).

1️⃣ Find an expense report you wish to approve, using the previous day or next day button.

2️⃣ Select one or more expense entries.

3️⃣ Click the approve selected expenses link.

A dialog box will open, asking you if you want to approve this expense report. Click Yes. If the expense is billable it will appear in the unbilled column in Job Tickets. Both billable and unbillable expenses will appear on job cost reports.

1️⃣ Find the expense report to unapprove by using either the find tool or scrolling using the previous and next toolbar buttons.

2️⃣ Click on the unapprove toolbar button.

A dialog box will open that confirms that the expense report has already been approved and asking you if you want to unapprove this expense report. Click Yes. The expense items will be removed from the job ticket and will no longer appear on job cost reports.

Expenses can be summarized for any period of time (choosing either invoice date or date posted), for one period or all periods, and for one item or all items. These options let you find the expenses for a specific purpose, such as the quarter’s expenses for color copies, for example.

Expense reports show only approved expenses; unapproved expenses appear only on the Unapproved Expense Report.

To print expense reports

1️⃣ From the Expenses window, click the print Reports button (or choose File > Print Expense Reports).

2️⃣ Select date added or date posted from the From pop-up menu, then enter a range of dates.

3️⃣ Select an accounting period, or choose All Periods to see expenses by date only.

4️⃣ Enter an item description, or leave the selection as ALL.

5️⃣ Select the report you wish to print.

6️⃣ Click Print.

✳️ How A/Ps affect the General Ledger Debit and credit journal entries are created in the G/L when an invoice is posted. A credit journal entry is made for the invoice's total for a liability G/L account (i.e., the cGL. Debit JEs are made for each line on the invoice, into either a job cost, media cost, or overhead expense G/L account (i.e., the dGL). The journal entries are a permanent record in the General Ledger. Even if an invoice is unposted, it's original JEs remain on the audit trail forever.

TIPS

📌 Expense reports are selected primarily by date added or date posted. This option lets you show only expenses added in July, for example, instead of the entire year. By entering a range of dates, you can select all expenses added today, last week, or all month -- whatever time period you need. There’s no limit to which range of dates you can use.

FAQs

💬 "How do I handle invoices charged to credit cards?" Cash basis and accrual basis accounting are the two most widely recognized methods of tracking a company's income and expenses. The primary difference between the two methods has to do with when the recognition of income and expenses occur. Under the cash method, income is recognized when a payment is received and expenses when a check is written.

💬 "How do I write off an invoice that we're not going to pay?" Cash basis and accrual basis accounting are the two most widely recognized methods of tracking a company's income and expenses. The primary difference between the two methods has to do with when the recognition of income and expenses occur. Under the cash method, income is recognized when a payment is received and expenses when a check is written.

💬 "How do I add media invoices if we don't track accruals?" Cash basis and accrual basis accounting are the two most widely recognized methods of tracking a company's income and expenses. The primary difference between the two methods has to do with when the recognition of income and expenses occur. Under the cash method, income is recognized when a payment is received and expenses when a check is written.

💬 What does "client paid" mean? If you bill clients for a job's costs, those billings only indirectly affect the job's vendor invoices*. So Clients & Profits keeps track of when a job's vendor invoices were billed, and tags those invoices with the client's A/R invoice number. When the client later pays for the billing, Clients & Profits will add the payment date back to the job's A/P invoices. This payment date also appears on the A/P Invoice Aging in Snapshots. *unless you do a Cost/WIP billing, which itemizes a job's costs on the client's invoice.

SEE ALSO

Reimburse Staffers

Standard Expense Categories

Expenses FAQs

EXPLAINERS

Clip Notes

© 2026 Clients & Profits, Inc.