Reimbursing Staffers for Out-of-Pocket Expenses

It's quick & easy to reimburse staff members (and freelancers) who paid for out-of-pocket expenses with their own money.

--

--

If a staff member pays for something the shop uses with their own money, they need to be reimbursed for what they spent. Freelancers, too, can be reimbursements for out-of-pocket expenses they incur.

An expense report is made up of a staffer's expenses that have the same date. Each expense report can then be reimbursed, one day per reimbursement. How the reimbursement is handled depends on these situations:

⚠️ Only users with the accounting permission to write checks for expense advances (or expense reimbursements) can use this feature. Also, expenses have to be approved before they can be reimbursed.

✳️ The staffer (or freelancer) used their own money The selected expense report's total can be reimbursed with a check now or as an A/P invoice to be paid later. If you choose a check, a reimbursement check will be saved & posted for the staffer/freelancer automatically, and only needs to be printed & signed.📍See demo data: expenses posted on 10/15/19 for Eli Winslow (EW)

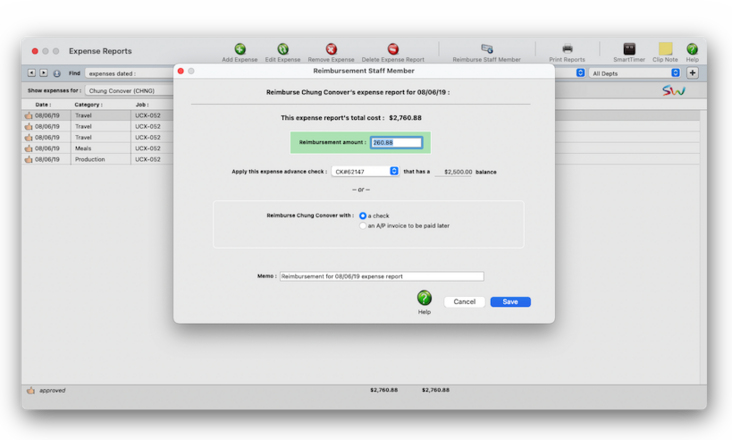

✳️ The staffer (or freelancer) got an expense advance check, but spent more than the advance When the expense report exceeds expense advance, the company owes the employee the difference. There's two ways to pay them back: pay them now with a check, or pay them later by adding an A/P invoice. Once saved, This entry will zero out the expense advance check's balance.📍See demo data: expenses dated 8/6/19 for Chung Conover (CHNG)

✳️ The staffer (or freelancer) got an expense advance check, but spent less than the advance In this case, the employee owes the company money and needs to write a check to pay it back. You'll enter the employee's check number then deposit the check with the next batch of deposits. The entry will zero out the expense advance check's balance

⚠️ Reimbursement invoices can only be added to staff members (or freelancers) who also have a vendor account already set up for them.

🔹To add an expense reimbursement, open the Expense Reports window, find the expense report, then click the Reimburse Staff Member toolbar button.

HERE'S HOW IT WORKS

• Any approved expense report can be reimbursed.

• Only one expense report can be reimbursed at a time.

• Reimbursements can be made to any staff member or freelancer

• No vendor account required for the staffer/freelancer.

• You can add a reimbursement for your own expense reports.

• Expense reports can sync with employee expense advance checks.

• Expense reports can sync with employee expense advance checks.

• If an employee spends more than the advance, CxP will cut a check for the difference.

• As an option, an expense reimbursement can be saved as an A/P invoice instead.

• Reimbursements are saved to the Checkbook as posted checks, updating the G/L automatically.

• Reimbursements can't be electronic payments (e.g., Zelle), only checks.

• Each entry on an expense report gets tagged with the reimbursement's check or A/P number.

Listen to a podcast about how to get the most out of Clients & Profits's most useful project management features (5:06 mins)

TO REIMBURSE SOMEONE WHO DIDN'T GET AN EXPENSE ADVANCE

1️⃣ Find the expense report you wish to reimburse.

2️⃣ Click the Reimburse Staff Member toolbar button.

3️⃣ Enter the amount to reimburse the employee

4️⃣ Decide how you want to pay out the reimbursement: click on a check or an A/P invoice to be paid later.

5️⃣ Enter a memo to describe to the staffer/freelancer what's being reimbursed, which appears on the printed check.

6️⃣ Click Save.

If you chose a reimbursement check, it will be immediately saved into the Checkbook as a posted check. All it needs is to be printed & signed. If you chose a reimbursement invoice, you'll see it saved in Accounts Payable. It will need to be proofed & posted before it can be paid later on your next vendor invoice check run.

1️⃣ Find the expense report you wish to reimburse.

2️⃣ Click the Reimburse Staff Member toolbar button.

You'll first see the total cost of the staffer/freelancer's expense report. If they were given an expense advance, it will selected automatically. The reimbursement amount will be calculated as difference between the advance and the total expenses. If the staffer/freelancer spent more than the advance, then the company owes them the difference. But if the staffer/freelancer spent less, then the difference is owed the company.

3️⃣ Confirm the reimbursement amount.

4️⃣ Confirm the expense advance check from the pop-up list, if there's more than one.

📎 If the employee entered multiple expense reports (i.e.. over multiple days) that in total are less than the advance amount, do not use the reimburse feature. C&P only makes the correct accounting entries into the G/L if all the employee's expenses are on one report where the total of the expense report plus the reimbursement amount from the employee equals the amount of the advance check.

5️⃣ Decide how you want to pay out the reimbursement: click on a check or an A/P invoice to be paid later.

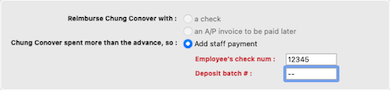

👉 If the staffer (or freelancer) spent more than their expense advance, enter their check number and optional batch number (which used for the bank reconciliation). In this case, Clients x Profits will automatically choose the Add Staff Payment option and prompt you to enter the employee's check number & optional deposit batch number.

6️⃣ Enter a memo to describe to the staffer/freelancer what's being reimbursed, which appears on the printed check.

7️⃣ Click Save.

The reimbursement check is automatically posted, so all you have to do is print the check and give it to the employee to reimburse them for their additional out-of-pocket expenses.

TIPS

📌 The entire expense report must be approved before it can be reimbursed.

FAQs

💬 What happens in the expense report is less than the expense advance? The reimbursement amount will be applied to the expense advance check, keeping a running balance of the remainder. You can keep adding reimbursements to expense reports until it is used up.

💬 Does the expense reimbursement check appear on the staffer/freelancer's year-end 1099? No. Reimbursements aren't income to the staffer/freelancer; instead, you're just paying them back for a business expense they paid for personally.

💬 What if I have several expense reports, all entered over different days, that need to be reimbursed? Yes, the Re-number utility will change all of a staff member's time entries, job tasks, etc. automatically. If the staff member also has a vendor account (which is used for expense report reimbursements) it will be renumbered as well.

💬 What happens if an expense report is partially approved? Can I still add a reimbursement? No, all of the expense report's entries have to be approved before they can be reimbursed.

SEE ALSO

Writing Checks for Expense Advances

Standard Expense Categories

Expenses FAQs

EXPLAINERS

Media Vendors

© 2026 Clients & Profits, Inc.