Writing Checks for Overhead Expenses

Overhead checks pays for goods or services for your shop's own use. They don't have jobs and tasks, and can't be marked up or billed to clients.

--

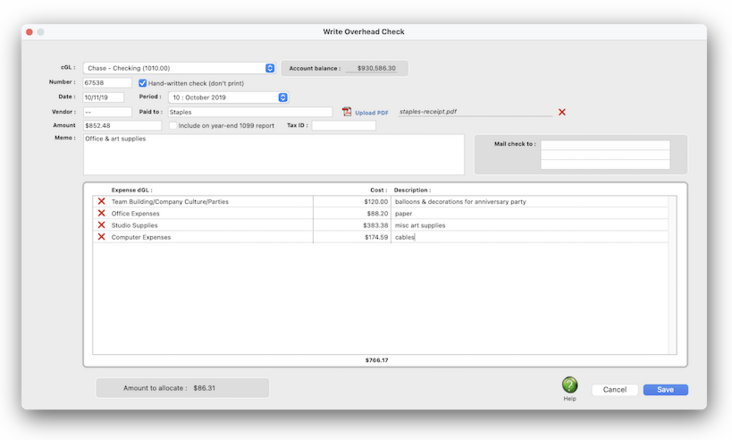

--

Overhead checks are written for expenses for which there are no vendors, such as one-time suppliers like delivery services. Unlike job cost checks, overhead checks aren’t vendor payments for unpaid invoices. Otherwise, everything you’ll enter about an overhead expense check is the same -- account number, check number, date, amount, accounting period, and a memo that describes the purchase.

An overhead expense check can be written to anyone (i.e., they don’t have to be vendors).

A single check can be distributed to any number of overhead expense accounts (i.e., debit G/L accounts). Because overhead expenses don’t affect jobs, overhead expense checks don’t include jobs and tasks..

Writing checks for overhead expenses saves you the step of entering the vendor’s invoice into Accounts Payable. If you buy an expense by check, be careful that no one enters the invoice later by mistake. If this happens you’ll be paying twice for the same purchase.

✳️ Writing checks for one-time vendors. Checks can be written for one-time vendors without adding a vendor account. When adding the check, leave the vendor field blank then enter the paid to name.

🔹To write checks, open the Checkbook window then click the Add toolbar button, then choose Overhead Expense Check at the prompt.

HERE'S HOW IT WORKS

• A check can be written to anyone; they don’t have to be vendors, either.

• A PDF of an invoice, quote, estimate, etc. can be attached to the check.

• Handwritten checks won't be printed.

• Internal approval isn't needed for checks, but there's an option to require someone else to post checks.

• When the check is posted, this amount will debit the employee receivables G/L accounts.

⚠️ Any staff member with permissions (i.e., access privileges) to the checkbook can write checks for overhead expenes.

📎 You can enter dozens of overhead expense accounts onto a check’s distribution. But the expense amounts on the line items are totaled, and must equal the check’s amount or else the distribution can’t be saved.

TO WRITE A CHECK FOR OVERHEAD EXPENSES

1️⃣ From the Checkbook window, click on the Add toolbar button.

The Add Checks & Bank Transfers dialog box opens, prompting you to select the type of payment you wish to make.

2️⃣ Click on the Overhead Expense Check radio button, then click OK.

3️⃣ From the Write Overhead Check window, confirm the bank account from the cGL pop-up menu, then confirm the check number.

The G/L account number determines from which bank account this check will be written. You can manage many bank accounts, writing checks and making deposits by entering a different G/L account number. Only G/L accounts that are tagged as checking accounts can be used for employee expense advances. When you choose the account to use, you'll see the account's current balance displayed.

📎 Checks are numbered automatically based on the cash account’s G/L number. You can change the number by typing in a new number over the old. Changing the check number doesn’t affect the next check’s number -- it will be the next check number in sequence.

4️⃣ Enter the check date, then confirm the accounting period from the pop-up menu.

This is the date the check was added. It is entered as today’s date automatically, but can be changed. The date appears on the printed check. It does not affect posting or the General Ledger (unlike the period). Cash reports can be printed by check date, showing all of the checks that were written for a range of dates. The accounting period determines how this check will affect your financial statements. The current period is copied from Preferences, but can be changed. A check can be posted into any unlocked accounting period.

👉 Is this a hand-written check? The handwritten check option keeps the check from being printed. It should be checked only for checks that shouldn’t be printed. It can be changed later, if needed.

5️⃣ Enter the vendor number (optional) and paid to (i.e., payee) name (not optional).

If the vendor has an account in Clients & Profits, its name, address, and tax information will be copied to the check. If not, you’ll need to add the payee name, mailing address, and tax ID number (for 1099s) manually.

6️⃣ Enter the check amount and the (optional) tax ID.

This is the amount you’re paying for the overhead expense. Tabbing past the check amount displays the written amount, which can’t be edited. When the check is posted, this amount will debit one or more expense G/L accounts.

👉 1099-able? The "Include on year-end 1099 report" checkbox controls if this payment will be included in the total amount printed on the 1099 for this vendor. It will be checked by default if this vendor is set to include payments on the 1099 (Setup > Vendors, then select this option setting in the Account Info window). However, not all payments for a vendor must be included on the 1099, so C&P provides the flexibility to include or exclude certain payments on the 1099 total via this checkbox. The tax ID is typically be the payee's Social Security Number.

7️⃣ If you have a PDF of the invoice, estimate, quote, etc. you can attach it to this check by clicking the upload PDF link then selecting the PDF file from your desktop. You can view the check's PDF anytime from the Checkbook window.

8️⃣ Enter the check memo and the (optional) mail check to address.

The memo describes what is being purchased by this check. It appears on cash reports and G/L reports. If you're going to mail the check, enter the payee's mailing address.

⚠️ Clients will see the check memo on Cost WIP billings & invoice detail reports. However, not all checks for a vendor must be included on the 1099, so C&P provides the flexibility to include or exclude certain checks on the 1099 total via this checkbox.

📎 For security reasons, you won't be able to change the check's mailing address after it is posted. However, not all checks for a vendor must be included on the 1099, so C&P provides the flexibility to include or exclude certain checks on the 1099 total via this checkbox.

9️⃣ For each expense, enter the debit G/Laccount name, the cost amount, and a description of what you're buying. Repeat these steps for the check’s remaining expenses.

This account will be debited when the check is posted. If you’re not sure about a G/L account number, leave the field empty then press Tab. The Chart of Accounts lookup list opens, listing your G/L accounts. When you find the right account, double-click on it to copy it to this expense item.

🔟 Click Save.

Once the overhead expense check is saved, it can be proofed, changed, or deleted anytime before it is posted. The check doesn’t update the General Ledger until posting. Posting creates journal entries. Overhead expense checks don’t affect vendor balances, since they’re not paying off invoices. Unposted checks don’t appear on job, cost, or accounting reports.

TIPS

📌 For better accountability, the check # entered on the check should match the pre-printed number on the check stock. To change the next sequential check number, you can change the check number in the cash account. Once you’ve saved this check, choose Chart of Accounts from the Setup menu. Find the account you wish to change, then double-click on it. The next check number for this account appears at the bottom of the Edit Account window. Changing it here will affect the next check to be added.

FAQs

💬 Can I change the check # on a job cost check? No. The job cost check's number can't be changed once the check is saved. If you need to give the check a different number, you'll have to delete the check and add it over again.

SEE ALSO

Checkbook

Bank Reconciliation FAQ

EXPLAINERS

Pass-Through Accounts

© 2026 Clients & Profits, Inc.