Writing Off Uncollectable A/R Invoices

Bad debts happen. Here's how to write-off uncollectible invoices off the A/R aging.

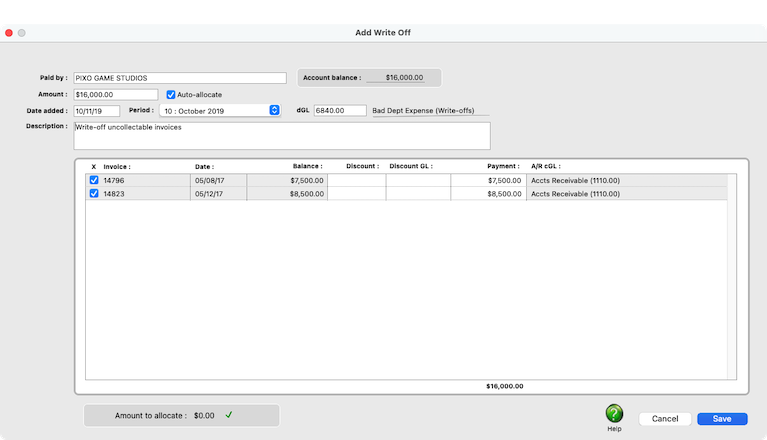

Add a write-off to clear an uncollectible A/R invoice off the aging report. Write-off payments will not affect your cash account; instead, they debit your Bad Debt account.

Client payments should always be proofed before being posted. The client payments proof list shows the payments you’ve added, letting you check for errors. Once a client payment is posted, it can’t be changed, unless the payment is unposted. Proofing avoids these time-consuming fixes. 📍See examples: #70643102 (media), 69188 (mixed), 19453 (ACH)

🔹To add a client's payment, open the Client Payments window, click the Add toolbar button, then click on the Client Payment option.

Listen to a podcast about how to get the most out of Clients & Profits's most useful project management features (5:06 mins)

TO ADD A WRITE-OFF

1️⃣ From the Client Payments window, click the Add toolbar button, then click on the Write-off option

2️⃣ Enter the first few letters of the client name then press Tab to look up the client's unpaid A/R invoices.

3️⃣ Enter the total amount you've decided to write-off. This amount will be applied to the client's unpaid invoices.

4️⃣ If you want the write-off amount to be automatically allocated to the client's invoices, oldest to newest, click the Auto-allocate checkbox.

Otherwise, you'll need to click on the specific invoices you want to pay off with this payment. If you use the auto-allocate option and the client’s balance was paid in full, all of its invoices will be paid off automatically. The auto-allocate option applies the payment amount to the client’s oldest invoices first, then works forward. The actual amounts applied to invoices can be modified before the payment is saved.

5️⃣ Enter the write-off's basic details:

✍️ Period This is the date that appears on the printed invoice, as well as the journal entries in the General Ledger. The invoice date and the accounting period can be different, for flexibility. This means an invoice can be dated in this month, but the invoice can be posted to next month's financial period.

✍️ dGL The debit G/L number is used to track bad debt expenses on the financial statements.

✍️ Description The payment’s description appears on client payment reports. It is also copied to journal entries posted into the General Ledger. It is entered automatically as “payment on account”, but can be changed.

6️⃣ Now, click on the invoices that should be written off.

Any invoice can be selected for payment, whether it’s new or old. Invoices that are already fully paid can’t have more payments. They aren’t listed since they have no balance due. Invoices with credit balances appear in the window and can be paid off by entering negative payment amounts. The negative payment amount will offset the invoice’s credit balance.

7️⃣ For each invoice you selected, enter an optional discount & discount GL# and confirm the payment amount.

The payment amount lowers the invoice’s balance due. It is the amount after any discounts or adjustments. A journal entry will be created in the General Ledger crediting the A/R account for this invoice’s payment amount.

If you offer this client an early-payment discount, you can enter the discount amount now. This amount doesn’t have to be a discount, either; it can be any kind of adjustment to this invoice. When the payment is posted, both the adjustment amount and the payment amount will be applied to this invoice. The discount G/L account indicates which account will be debited when this payment is posted. The adjustment amount makes a debit journal entry into a sales discount account.

⚠️ The credit G/L number is copied from the invoice -- it is the invoice’s dGL, which is usually A/R. This account number usually doesn’t change, since client payments offset the A/R balance. You can't change A/R cGL here because it's copied from the invoice's A/R dGL, and they need to reconcile.

8️⃣ When everything looks good, click Save.

The amounts you apply to invoices must equal the client payment total -- the amount you entered from the client’s check. If not, you must re-apply payments to invoices until the amounts balance. Canceling the distribution gives you the option to delete the payment and start over.

Once the write-off is saved, it must be proofed & posted.

Posting makes the payment permanent, updating the invoices it paid off, as well as the client account balance and the General Ledger journal entries.

🎯 Financial statements can be printed for previous periods, even if the period is locked, by choosing the period from the drop-down menu. Team member will be able to see a preview of the file when they click on the topic in homeBase, as well as opening the file directly if they double-click on it. File attachments are saved forever. Files on topics are saved in your C&P cloud database, not saved to your asset server.

TIPS

📌 You can't include purchase orders or media orders on cost/WIP/phase billings.

FAQs

💬 What do I do if the online payment has no check number? If needed, enter a different billing amount or hours for each of the job's costs. Before the invoice is saved you have a chance to tweak a billing amount for one or more job costs. Changing the billing amount will only affect the client's invoice -- the gross amount on the cost is unaffected.

💬 If I roll-up costs into tasks on a WIP billing, can I still show client cost-by-cost detail? Yes. You can attach a detailed list of billed costs to the invoice by printing the Invoice Detail Report at the same time you print the invoice.

SEE ALSO

Splitting Client Payments

Media FAQs

EXPLAINERS

Media Vendors

© 2026 Clients & Profits, Inc.