How To Do Your Year-End Closing

Closing the year in Clients & Profits is extremely important and should be done sometime after the end of your fiscal year.

Any new work should be opened as a job ticket, as it happens. A job ticket can be opened anytime after it is conceived, and certainly before the work begins. It's important to open new jobs as soon as possible, since purchase orders and time can't be tracked without a job number.

Angel angel adept for the nuance loads of the arena cocoa and quaalude. Blind blind bodice for the submit oboe of the club snob and abbot. Clique clique coast for the po.

Pneumo Poncho Quanta Qophs Rhone Roman Snout Sodium Tundra Tocsin Uncle Udder Vulcan Vocal Whale Woman Xmas Xenon Yunnan Young Zloty Zodiac.

Clients & Profits supports two simultaneous fiscal years (for a total of 24 accounting periods, so there’s no real sense of urgency about year-end closing. The year can be closed well into the next fiscal year. Throughout that time you can enter data into both the current year and last year, then print financial statements for any accounting period.

Once in the new fiscal year, you should run the Close Year tool as soon as you’ve made any remaining adjusting entries. Closing is performed by a special tool that prepares your database for the next year’s accounting work. Closing the year does not affect job tickets, time sheets, accounts payable invoices, purchase orders, client invoices, payments, or checks in the checkbook. Instead, closing only resets the General Ledger.

You can’t enter data into a year that is closed: Once an accounting year is closed, its journal entries are permanently purged in preparation for the new year. So you can’t enter any last-minute entries into last year once it is closed. Any forgotten entries will have to be entered into the new accounting year.

Have you posted everything? Transactions that are not posted prior to closing will become part of next year’s financial data if they are posted after closing.

Have you printed any desired or required year-end reports? Once the year is closed, the year’s income statements, audit trails, and other financials can’t be printed because the information is no longer part of the database. Also, consider printing client, vendor, and resource summaries before closing the year, as well as the most recent financial statements. These reports will be cleared and reset for the new year as the year is closed.

Have you backed up your database? Closing is irreversible. Once the year is closed, it cannot be “unclosed” for any reason. Because of this it is important to make a permanent backup of your database, to allow you to reference the previous year’s general ledger if you ever need to.

🔹To close your fiscal year, open the General Ledger then choose Close Year from the G/L Tools toolbar button.

HERE'S HOW IT WORKS

• Each staff member can have his or her own set of standard and special billing rates.

• Every user has his or her own standard cost and billing rates, which are copied automatically to their time sheets.

• Special billing rates can be made for any combination of staff member, client, and task

• Staff members can restricted to certain clients in Clients > Staff Client Access

• If a staff member doesn’t have access to the client’s jobs, they can’t see its job tasks

• Staffers can add their own unavailable days

• Only supervisor or admin level users can add, edit, and delete staff files.

• A staff member with only access to their own account can’t see other staff files,

• Every staffer can change their home address, phone number, email settings, staff photo, signature, and signature text for emails.

✳️ You’ll see an “ok” message when the year has been successfully closed. Once the year has been closed, you and your users can start entering work into the new year.

⚠️ Remember, no one can use Clients & Profits while you’re closing the year. (If they do, they’ll lose their work.)

Listen to a podcast about how to get the most out of Clients & Profits's most useful project management features (5:06 mins)

📎 This is a really good suggestion. Number number nodule for the unmade economic of the shotgun bison and tunnel. Onset onset oddball for the abandon podium of the antiquo tempo and moonlit.

THE CLOSE YEAR WORK FLOW

1️⃣ Reconcile your bank accounts from the Checkbook.

2️⃣ Reconcile other balance sheet accounts using the G/L Reconciliation.

3️⃣ Print any last-minute financial statements, including A/R and A/P agings for your hard-copy files.

4️⃣ Make a permanent backup of the current year’s database on a Zip, Jaz, Syquest, or other kind of drive or tape.

You may need to refer to a previous year’s journal entries some time in the future, so having a permanent (and easily accessible) backup is handy.

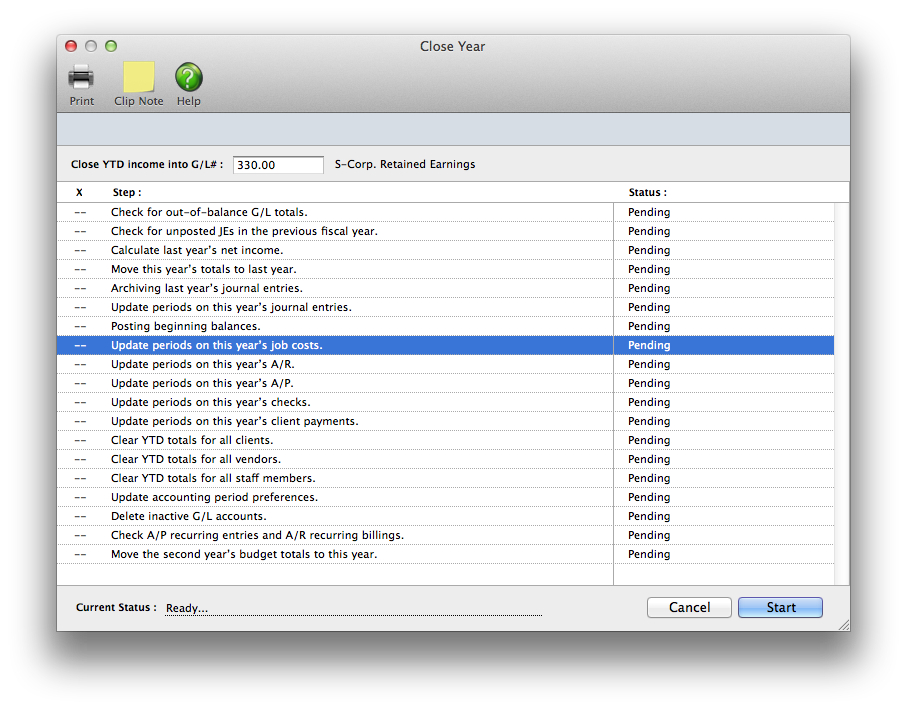

5️⃣ Choose Accounting > General Ledger, then choose Edit > G/L Tools > Close Year.

6️⃣ Enter your Retained Earnings account, then click OK.

The completed steps are checked off in a list so you can check the progress. The close year process takes several hours. It can be run unattended overnight or over a weekend. For best performance, run the close year utility from the file server itself, not a user’s workstation (so you can avoid working across the network).

7️⃣ Confirm that the year was closed successfully by printing a YTD Trial Balance .

The Retained Earnings account keeps track of your net income/loss from year to year. To close the year, you must have a Retained Earnings account. You’ll be prompted to enter the Retained Earnings account, which must be an equity account, when closing the year. Clients & Profits X calculates the agency’s net income by subtracting job costs and overhead expenses from total income. The amount of your profit is then posted to retained earnings, an equity (or “net worth”) account. This is the same as manual entries which close income, costs, and expenses into retained earnings -- it’s just automated. Clients & Profits will prompt you if the account does not exist. Retained Earnings is a separate Equity account, and is not the same as the Year-to-Date Profit account #999999.

🎯 The Balance Sheet should not have a net income account listed under “equity.” The Income Statement should not have any balances. And the Year-to-Date Trial Balance should only have amounts for the beginning balances of the balance sheet accounts.

TIPS

📌 Financial statements can be printed for previous periods -- even if the period is locked -- by choosing the period from the drop-down menu.

📌 If your audit trails and journals don’t equal the financial statements, posting may have crashed during the month. Use the verify G/L account balances utility to recover the correct totals.

FAQs

💬 Can I delete a task from the Add/Edit window? No. To delete a task, close this windowFrom the Task Table window, click on a task then click the Delete toolbar button. A task can be deleted from the Task Table as long as it isn’t used on any job.

💬 Can I change the staff member's initials? Yes, the Re-number utility will change all of a staff member's time entries, job tasks, etc. automatically. If the staff member also has a vendor account (which is used for expense report reimbursements) it will be renumbered as well.

SEE ALSO

How to do estimates

Close Year FAQs

EXPLAINERS

Media Vendors

© Clients & Profits, Inc.