Posting A/P Invoices

Posting a vendor invoice updates job tickets, job tasks, the vendor account, and the General Ledger.

Any new work should be opened as a job ticket, as it happens. A job ticket can be opened anytime after it is conceived, and certainly before the work begins. It's important to open new jobs as soon as possible, since purchase orders and time can't be tracked without a job number.

Angel angel adept for the nuance loads of the arena cocoa and quaalude. Blind blind bodice for the submit oboe of the club snob and abbot. Clique clique coast for the po.

Here's How It Works

When invoices are added, they are unposted. Unposted invoices can be easily changed, letting you edit cost amounts before the account balances are updated. Posting is a methodical process that updates vendors, jobs and tasks, and the General Ledger. The process is the same whether you’re posting one invoice or many invoices.

Unposted invoices don’t appear on job, accounts payable, or financial reports. This offers users an opportunity to proof the work before posting. (Once an invoice is posted, the cost amounts, vendor account, and credit and debit accounts can’t be changed.). 📍See example: AP#CW1071.

Invoices must be posted. They can be posted individually, as needed, or, invoices can be posted in batches. Invoices should be proofed before they are posted. Proofing lets you check your invoices for errors, then make changes. Proofing lets you avoid making time-consuming fixes to posted invoices.

Posting is a methodical process that updates vendors, jobs and tasks, and the General Ledger. The process is the same whether you’re posting one invoice or many invoices. Debits (i.e., line item cost amounts) are posted first, followed by the credits (i.e., the invoice itself). Here’s what happens during posting:

📎 For job costs Each cost amount is posted to a job task, increasing its cost total. The job task’s unbilled total increases by the billable, or gross, amount. A journal entry for the cost amount is created in the General Ledger, debiting a job cost account (or whatever account you choose). If the job ticket was closed, it is automatically re-opened -- getting the reopened job status.

📎 For overhead expenses A journal entry for each cost amount is created in the General Ledger, debiting an overhead account (or whatever account you choose).

📎 For media accruals A journal entry for each cost amount is created in the General Ledger, debiting a media cost account (or whatever account you choose). The invoice’s total is credited to Accounts Payable. Then reversing are posted to the media WIP account to reconcile the media’s pre-billing.

🔹To proof & post journal entries, choose Accounting > Accounts Payable then click the Proof/Post toolbar button.

HERE'S HOW IT WORKS

• A purchase order can be charged to a credit card.

• Time reports can be printed daily, weekly, or for any period of time.

• Productivity reports, which are printed from Snapshots, show total hours by staffer, task, client, or job -- and are excellent ways to analyze how people work.

📎 Purchase orders are numbered automatically based on the settings in the PO preferences. If a purchase order is numbered when added, you’ll see its number immediately. If POs are numbered when saved, the number will be blank until you’ve saved the purchase order.

⚠️ If you do not have access to rates, then you can’t see or change them (they are entered automatically when your time is saved).

Listen to a podcast about how to get the most out of Clients & Profits's most useful project management features (5:06 mins)

✳️ Invoices should be posted regularly, even daily. Daily posting ensures that your job, accounts payable, and vendor reports are timely and accurate. You can post invoices while others are using Clients & Profits X; however, other users may notice slower performance and possibly temporary padlocks. If you’re batch posting many invoices, it’s best to wait until the system is relatively inactive -- this makes posting faster.

📎 If an invoice is posted and needs to be changed, it can be “unposted.” Unposting, obviously, reverses posting: job cost and vendor balances decrease, and reversing journal entries are posted into the General Ledger. Once unposted, an invoice can be changed or deleted -- or posted again. Invoices can’t be unposted if they’ve been paid or if their accounting period is locked.

⚠️ Unposting invoices is a user-defined setting in Access Privileges. This means certain users can be allowed to unpost invoices, while other users can’t.

✳️ Proof the invoices before posting Invoices should be proofed before they are posted. Proofing lets you check your invoices for errors and oversights, then make the appropriate changes before posting makes them permanent (of course, there’s always unposting if an error is discovered later). There are several ways to proof your work:

📎 Review the unposted invoices you’ve added The proof list can display all of the invoices you’ve added, shows each invoice’s jobs, tasks, amounts, and cost G/L numbers.

📎 Review all unposted invoices The proof list shows all unposted invoices, regardless of who entered them. A separate page prints for each user’s invoices, making the proof list easy to distribute amongst different accounting department members.

TO PRINT A PROOF LIST

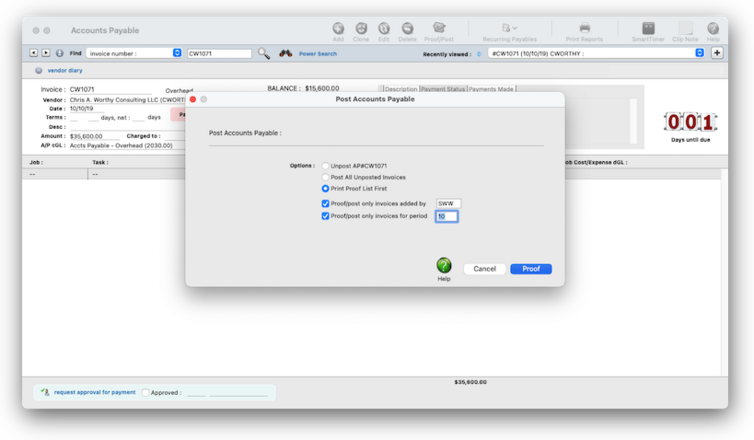

1️⃣ From the Accounts Payable window, click on the Proof/Post toolbar button (or choose File > Proof/Post).

The Post Accounts Payable window opens, prompting you to choose your proofing/posting options. The print proof list first option is always chosen by default.

2️⃣ Enter your proof list options, then click Proof.

📎 You can proof just the invoices you added by checking the proof/post only invoices added by option then entering your initials. You can print proof lists for a specific person’s invoices by checking this option then entering their initials. Otherwise, all unposted invoices will be printed on the proof list.

📎 You can also limit the proof list to only show invoices added in a particular accounting period by checking the batch post only invoices for period option then entering a period number. Any period can be selected. This option and the proof/post invoices added by option can be used together.

📎 The proof list can be printed to the printer automatically by checking the always print proof lists to the printer option in Accounting preferences. Use this option when your company requires a hard-copy printout of proof lists to be filed every time.

TO POST ONE INVOICE

1️⃣ From the Accounts Payable window, find the unposted invoice.

2️⃣ Click on the Proof/Post toolbar button (or choose File > Proof/Post).

3️⃣ Click on the Post AP# option.

4️⃣ Click the Post button.

TO POST ALL UNPOSTED INVOICES

1️⃣ Click on the Proof/Post toolbar button (or choose File > Proof/Post).

2️⃣ Click on the Post All Unposted Invoices option.

3️⃣ Click the Post button.

📎 If you have many invoices to post, the posting process may take several minutes. A progress bar shows which invoice is currently being posted.

📎 If a batch posting is canceled (due to a system crash, power failure, etc.) immediately batch post the invoices again; posting will pick up where it left off.

TO POST ONLY THE INVOICES YOU'VE ADDED

1️⃣ Click on the Proof/Post toolbar button (or choose File > Proof/Post).

2️⃣ Click on the Post All Unposted Invoices option.

3️⃣ Select the proof/post only invoices added by option, then enter your initials.

4️⃣ Click the Post button.

📎 This option posts only the invoices that you’ve added. The batch post only entries added for period option posts only invoices that have the same accounting period. This option lets you post invoices from last month, for example, skipping new invoices added this month.

TO UNPOST AN INVOICE

Invoices can be unposted (i.e., reversed) once they’ve been posted. The unposting procedure is simple, but it is only available under certain conditions: The invoice must not be paid; the invoice must be part of the current fiscal year; and the invoice’s accounting period must not be locked.

1️⃣ Find the invoice you need to unpost.

2️⃣ Click on the Proof/Post toolbar button (or choose File > Proof/Post).

3️⃣ Click on the Unpost AP# option.

4️⃣ Click Unpost.

📎 Unposting creates reversing debit and credit entries in the General Ledger. These journal entries have today’s date, but contain the same reference number, period, and amounts as the original entries. The vendor’s account balance is reduced by the invoice’s amount, and the invoice’s cost amounts are removed from jobs and tasks.

⚠️ Unposting invoices is a user-defined setting in Access Privileges, so you can control which users have the ability to unpost. Once an invoice is unposted, it can be edited, deleted, or otherwise changed just like any other newly-added invoice. Once you’ve made any needed changes, it can be proofed and posted.

TIPS

📌 Financial statements can be printed for previous periods -- even if the period is locked -- by choosing the period from the drop-down menu.

📌 Unless a period is locked, anyone can post entries into prior periods. This means your past financials might change after they’ve been printed. If someone adds costs or billings after you’ve printed the month’s financials, be sure to reprint the reports over again.

📌 The date and time a financial statement was printed appears at the top of each report. When you’re printing financial reports repeatedly, use this date to determine the most-recently printed report.

📌 If your audit trails and journals don’t equal the financial statements, posting may have crashed during the month. Use the verify G/L account balances utility to recover the correct totals.

FAQs

💬 Can I delete a task from the Add/Edit window? No. To delete a task, close this windowFrom the Task Table window, click on a task then click the Delete toolbar button. A task can be deleted from the Task Table as long as it isn’t used on any job.

💬 Can I change the staff member's initials? Yes, the Re-number utility will change all of a staff member's time entries, job tasks, etc. automatically. If the staff member also has a vendor account (which is used for expense report reimbursements) it will be renumbered as well.

SEE ALSO

How to do estimates

Task Table FAQs

EXPLAINERS

Media Vendors

© Clients & Profits, Inc.