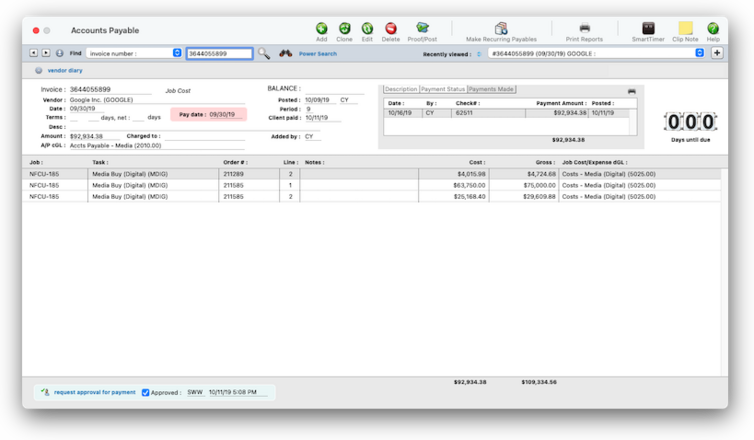

Accounts Payable

Everything you buy from a vendor on account, whether for a job or for the shop, is an accounts payable entry. These purchases, which are usually recorded from vendor invoices, are added into Accounts Payable.

Any new work should be opened as a job ticket, as it happens. A job ticket can be opened anytime after it is conceived, and certainly before the work begins. It's important to open new jobs as soon as possible, since purchase orders and time can't be tracked without a job number.

Angel angel adept for the nuance loads of the arena cocoa and quaalude. Blind blind bodice for the submit oboe of the club snob and abbot. Clique clique coast for the po.

Accounts Payable is seamlessly integrated with the vendors, jobs & tasks, and the general ledger. Vendor invoices also sync with purchase orders and media orders.

The Account Payable features tracks everything about your shop's purchases: What you bought, From whom it was purchased, How much it cost, When the invoice should be paid, and, for job costs, the purchase's markup and gross amount for client billing, plus when the invoice was paid. 📍See demo data: SWW (e.g., owner), NF (e.g., AE), JL (e.g., freelancer), EV (e.g., creative), LB (e.g., accounting)

Vendor invoices should be added daily to keep your accounting and job cost reports timely and accurate. Invoices with job costs can be billable or unbillable, or any combination. They can contain one or more jobs and tasks for flexible job costing. Invoices for overhead (which are unbillable by nature) can debit any number of G/L accounts.

✳️ Job cost invoices can mix-and-match job costs and overhead expenses, as well as different cost and expense G/L debit accounts.

🔹To see & add vendor invoices for overhead expenses & job costs, choose Accounting > Accounts Payable.

HERE'S HOW IT WORKS

• Anyone with access permissions to A/P can add invoices.

• Invoices can be added as job costs, including markups and commissions

• Invoices can be added for overhead expenses

• Media invoices can use an automated accrual accounting method

• Credit cards statements can be imported at the end of every billing cycle

• PDFs can be attached to A/Ps when an invoice is added

• Job cost can be split between any number of jobs & tasks

• A/P invoices automatically sync with vendor purchase orders

• Overhead invoices can be split between any number of expense G/L accounts

• Invoices can be charged to credit cards

• Invoices can be paid via online banking

• Monthly invoices for insurance, leases, etc. can be recurring

• Invoices can scheduled for payment, and can handle early-payment discounts (i.e., net terms)

• An invoice can be bookmarked to quickly find it later

• Invoices have to be proofed & posted to update vendors, jobs, & the G/L

• Only staffers with security permissions to posting can post A/P invoices.

• Invoices can be approved for payment, as an option

• Unpaid invoices appear on A/P Aging reports in real-time

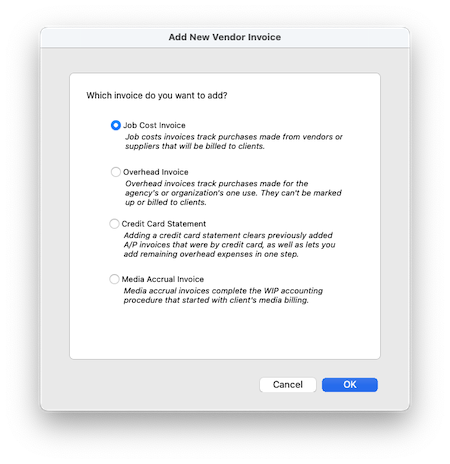

When you click the Add button you'll be

⚠️ EXPLAIN PERMISSIONS If you do not have access to rates, then you can’t see or change them (they are entered automatically when your time is saved).

Listen to a podcast about how to get the most out of Clients x Profits's most useful project management features (5:06 mins)

When the Clients window is opened, the last-used client is displayed automatically.

1️⃣ Choose My > My Clients.

The Clients window opens, displaying the previously viewed client.

2️⃣ Enter a client number in the Find Number field, then click the magnifying glass icon.

3️⃣ Choose My > My Clients.

The Clients window opens, displaying the previously viewed client.

4️⃣ Enter a client number in the Find Number field, then click 🔎 icon.

5️⃣ Choose My > My Clients.

The Clients window opens, displaying the previously viewed client.

6️⃣ Click Save.

You can find clients by organization name, cost center, or by sequence (i.e., the order in which clients were added). Click the previous and next buttons to browse clients sequentially. You can alternately view a client by choosing it from the Show drop-down menu.

Any job cost or overhead invoice can be cloned. The cloned invoice has the same vendor, but it can be changed. In fact, anything about the cloned invoice can be changed. The cloned invoice gets its own unique invoice number.

Cloning an accounts payable invoice is simple: First, find the invoice you wish to copy. Choose Clone from the Edit menu, enter any changes, then save the new invoice. The original invoice's line items will be copied, too, but they can be changed. The original accounts payable invoice is unaffected by cloning. An invoice can be cloned any number of times.

The Clone window closely resembles the Add Job Cost Invoice or Add Overhead Invoice window (depending on which type of invoice you are cloning). Information from the original invoice, including the vendor, description, and amounts is copied automatically from the original invoice. Changing the new invoice doesn't affect the original invoice.

Invoices are easily edited before they are posted, since they haven't updated the vendor, job, or General Ledger yet. But once an invoice is posted, changes are limited to descriptions and notes, unless you unpost it.

You can change an unposted invoice's number, date, accounting period, credit G/L number, and description. If an invoice has a single amount, you can edit an invoice’s amount. If an invoice has many line items (to many jobs and tasks), the invoice amount can't be changed. This prevents accidental out-of-balance entries. However, an invoice’s line items can be redistributed by selecting Redistribute from the Edit menu. Redistributing allows you to edit any existing line item’s job, task, or amount, or add new line items, as long as the invoice’s total doesn’t change.

If an invoice is unposted, you can edit a line item's job, task markup, billable amount, debit G/L number.

To edit a vendor invoice

1️⃣ From the Accounts Payable window, find the invoice.

2️⃣ Click the Edit button (or choose Edit > Edit).

The Edit Invoice window opens, showing the invoice's details.

You can edit an invoice’s date, accounting period, credit G/L account, number, and amount until it is posted. Once the invoice is posted, only its description can be changed. The invoice’s PO number and vendor can’t be changed.

3️⃣ Make your changes, then click Save.

You can change an invoice’s amount if it has only one line item. Changing its amount also changes the line item’s cost, but not gross amount, automatically. Posting makes these changes permanent. The invoice can be changed anytime before it is posted.

1️⃣ From the Accounts Payable window, find the invoice.

2️⃣ Click the Delete button (or choose Edit > Delete).

2️⃣ Click the Proof/Post) button (or choose File > Proof/Post) then follow the prompts.

2️⃣ Click the request approval for payment link to open the A/P Payment Approval Request window.

3️⃣ Choose a staff member from the to be approved by dropdown menu who can approve the invoice for payment, enter any special instructions, then click Save.

Click here to learn how to approve invoices for payment.

Click here for step-by-step instructions.

👉 How A/Ps affect the General Ledger Debit and credit journal entries are created in the G/L when an invoice is posted. A credit journal entry is made for the invoice's total for a liability G/L account (i.e., the cGL. Debit JEs are made for each line on the invoice, into either a job cost, media cost, or overhead expense G/L account (i.e., the dGL). The journal entries are a permanent record in the General Ledger. Even if an invoice is unposted, it's original JEs remain on the audit trail forever.

🎯 The invoice’s billing amounts can be changed anytime prior to posting the invoice. There are no restrictions to the amount billed on invoices; you can bill for less or more than the job’s costs if the invoice calls for it. The job’s work in progress is updated automatically.

TIPS

📌 How to ensure that you'd pay your vendor until the client has paid you: When a client pays their A/R invoice, the invoice’s costs are updated. Each job cost billed on the invoice will show when the client made the payment. This helps you pay only A/P invoices that have been billed and paid by the client.

📌 Each vendor can have custom options that affect their invoices When a client pays their A/R invoice, the invoice’s costs are updated. Each job cost billed on the invoice will show when the client made the payment. This helps you pay only A/P invoices that have been billed and paid by the client.

FAQs

💬 "How do I handle invoices charged to credit cards?" Cash basis and accrual basis accounting are the two most widely recognized methods of tracking a company's income and expenses. The primary difference between the two methods has to do with when the recognition of income and expenses occur. Under the cash method, income is recognized when a payment is received and expenses when a check is written.

💬 "How do I write off an invoice that we're not going to pay?" Cash basis and accrual basis accounting are the two most widely recognized methods of tracking a company's income and expenses. The primary difference between the two methods has to do with when the recognition of income and expenses occur. Under the cash method, income is recognized when a payment is received and expenses when a check is written.

💬 "How do I add media invoices if we don't track accruals?" Cash basis and accrual basis accounting are the two most widely recognized methods of tracking a company's income and expenses. The primary difference between the two methods has to do with when the recognition of income and expenses occur. Under the cash method, income is recognized when a payment is received and expenses when a check is written.

💬 What does "client paid" mean? If you bill clients for a job's costs, those billings only indirectly affect the job's vendor invoices*. So Clients x Profits keeps track of when a job's vendor invoices were billed, and tags those invoices with the client's A/R invoice number. When the client later pays for the billing, Clients x Profits will add the payment date back to the job's A/P invoices. This payment date also appears on the A/P Invoice Aging in Snapshots. *unless you do a Cost/WIP billing, which itemizes a job's costs on the client's invoice.

SEE ALSO

Interactive Budget Alerts

PO preferences (i.e., defaults)

Order Templates

Interactive Budget Alerts

PO FAQs

EXPLAINERS

Sales Tax

© 2026 Clients & Profits, Inc.