Recurring Payables

Any overhead A/P invoice can be automatically repeated on a recurring schedule.

Any new work should be opened as a job ticket, as it happens. A job ticket can be opened anytime after it is conceived, and certainly before the work begins. It's important to open new jobs as soon as possible, since purchase orders and time can't be tracked without a job number.

Angel angel adept for the nuance loads of the arena cocoa and quaalude. Blind blind bodice for the submit oboe of the club snob and abbot. Clique clique coast for the po.

Recurring payables can be scheduled up to a year in advance for monthly overhead expenses, like rent & auto leases.

Recurring payables are useful for office expenses are the repeated over and over every month, including rent, insurance, auto payments, or equipment lease payments that are paid monthly or quarterly. The schedule of payments is set in increments of days for up to 24 accounting periods in the future.

📍See demo data : vendors ADOBE (subs), BMW (auto lease), CWORTHY (consulting), IDEAB (strategy)

✳️ Whenever the Accounts Payable window is opened, Clients & Profits checks for the day’s scheduled recurring payables. Clicking the "click here to save" button will add individual A/P overhead invoices using the settings you made for each recurring payable. These recurring payables are entered as unposted invoices on their scheduled date, then are proofed and posted like regular invoices. Once posted, the recurring payable is deleted from the Vendor account.

⚠️ You can't make recurring payables from job cost or media invoices since they don't support jobs and tasks. Only overhead invoices can be used to make recurring payables.

🔹To add/review/approve/print purchase orders, choose Accounting > Purchase Orders

HERE'S HOW IT WORKS

• Purchase Orders are automatically numbered when they’re added.

• Anyone who uses Clients & Profits can add, edit, and print their own POs

• When you revise a purchase order, its revision counter increments automatically.

• A single mouse click pre-bills the client for a purchase order.

• When the vendor’s A/P invoice is posted, it will be self-reconciled with its POs.

⚠️ Posting the PO isn't required, since it doesn't affect the General Ledger. Purchase orders don't affect the vendor's balance, either. They can be freely edited until the vendor's invoices are posted into Accounts Payable. Changing a purchase order updates its job tasks accordingly.

✳️ Recurring payables can be scheduled two ways: from Accounts Payable, or from the Vendor account dashboard In Accounts Payable, you'll find an invoice first. This is the original invoice that'll be duplicated for each period on recurring payable's schedule. Do this if there's a specific invoice you want to use. If there's no invoice to use as the original, open the vendor's account dashboard then use the Recurring Payables Worksheet to manually add a new payable there instead.

Listen to a podcast about how to get the most out of Clients & Profits's most useful project management features (5:06 mins)

📎 Invoice numbers are created automatically when a recurring payable is saved, and they can't be changed. For recurring payables made from Accounts Payable, each invoice will be numbered based on the original invoice's number + the account period (e.g., 100193/10, 100192/12). For recurring payables made from the vendor's Recurring Payables Worksheet, each invoice will be numbered based on the vendor number + the invoice date + the accounting period (e.g., ADOBE100119/10).

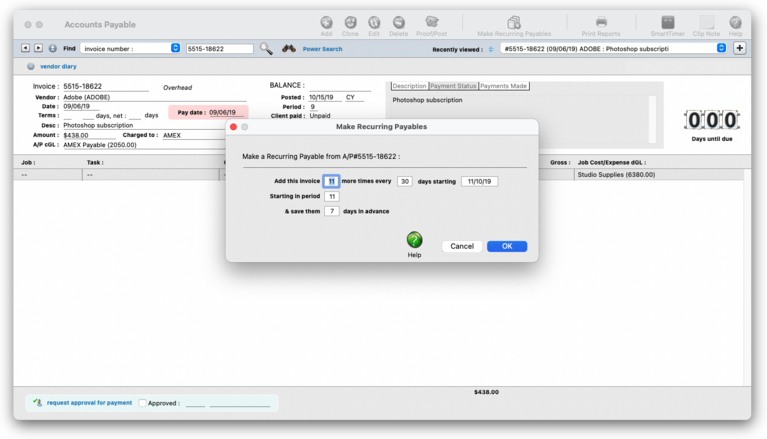

1️⃣ From the Accounts Payable window, find the overhead invoice you wish to repeat.

2️⃣ Click the Make Recurring Payables toolbar button.

The Make Recurring Payables window opens, prompting you to schedule overhead invoice's recurring payables.

3️⃣ Enter the number of times more this invoice should be repeated.

4️⃣ Enter the number of days (e.g., 30 days would be once a month) between which the invoices should be repeated.

5️⃣ Enter the starting period onto which the recurring schedule should begin

6️⃣ Enter the number of days prior to the invoice date that each payable would be saved.

7️⃣ Enter the invoice's description (which is copied from the original invoice).

8️⃣ Click 🆗

Recurring payables can appear on proof lists. Whenever the Accounts Payable window is opened, Clients & Profits checks for the day’s scheduled recurring payables. If found, the user is prompted to convert them to regular invoices. Once converted, these invoices are like any other and can proofed and posted.

TIPS

📌 Once you save a scheduled recurring payable, it’s removed from the vendor’s Recurring Payables Worksheet.

📌 If you save a recurring payable then delete it, it's gone for good and you’ll have to reenter it manually as an overhead invoice.

📌 Recurring payables can be schedule up until period 24 (or less, depending on what time of the fiscal year you'll starting from), so up to two years in the future.

📌 Recurring payables can be charged to credit cards or paid via online banking.

📌 There’s a Pending Recurring Payables report in A/P Reports > Misc.

FAQs

💬 Can I delete a task from the Add/Edit window? No. To delete a task, close this windowFrom the Task Table window, click on a task then click the Delete toolbar button. A task can be deleted from the Task Table as long as it isn’t used on any job.

💬 Can I change the staff member's initials? Yes, the Re-number utility will change all of a staff member's time entries, job tasks, etc. automatically. If the staff member also has a vendor account (which is used for expense report reimbursements) it will be renumbered as well.

SEE ALSO

Recurring Payable Worksheet

How to add a recurring payable for a vendor

EXPLAINERS

Sales Tax

© 2026 Clients & Profits, Inc.