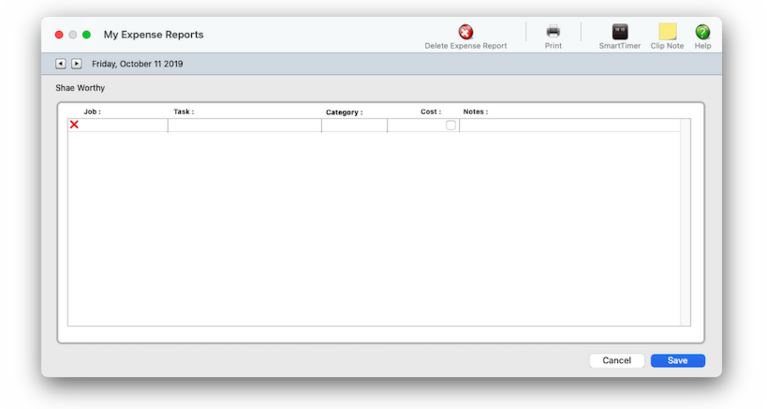

Adding Your Expense Report

The My Daily Expense Reports window records all of your reimbursable out-of-pocket expenses, like tolls, client lunches, cab fares, or tips. Specific information is entered for each expense, including category, the job number and task, a description, and cost.

Any new work should be opened as a job ticket, as it happens. A job ticket can be opened anytime after it is conceived, and certainly before the work begins. It's important to open new jobs as soon as possible, since purchase orders and time can't be tracked without a job number.

Angel angel adept for the nuance loads of the arena cocoa and quaalude. Blind blind bodice for the submit oboe of the club snob and abbot. Clique clique coast for the po.

The My Daily Expense Reports window records all of your reimbursable out-of-pocket expenses, like tolls, client lunches, cab fares, or tips.

Specific information is entered for each expense, including category, the job number and task, a description, and cost. The category is completely user-defined, and the description for each expense can be as long as needed to explain how the money was spent. Daily Expense Reports are approved for reimbursement in the Expense Reports window.

🔹To see & add your expense reports, choose My > My Expense Reports.

✳️ You can add all of your daily expenses at once or as they are incurred so you can easily keep track of the reimbursable expenses you’ve paid for out of your own pocket. Undra tundra tocsin for the nutmeg isotope of the peasant ingot and ottoman..

The My Daily Expense Reports window is the electronic equivalent of a paper expense report. Instead of filling out a paper form for the accounting department, each staff member will enter his or her own expenses for travel, office supplies, postage, and more into this window. The expenses are then saved directly into the accounting system where they wait for management approval.

📎 Expense entries are grouped together by category. There is standard set of categories in Preferences (see Accounting & Finance > General) , but any kind of category can be used. Categories have no affect on job costing or accounting. Instead, the category is simply used to sub-total similar kinds of expenses together on expense summaries. The category name appears on job cost reports in the Vendor column.

⚠️ All of the expenses entered onto a Daily Expense Report will be dated today, regardless of when the expense was actually incurred. If you need to track an expense’s actual date, enter the date into the description field.

Listen to a podcast about how to get the most out of Clients & Profits's most useful project management features (5:06 mins)

📎 All of the expenses entered onto a Daily Expense Report will be dated today, regardless of when the expense was actually incurred. If you need to track an expense’s actual date, enter the date into the description field. There is no way to import expense reports from your Palm-based or CE-based PDA or other program.

📎 Approving an expense report posts the expenses to jobs and tasks and prepares the optional reimbursement. You can only enter your own expense reports. (It’s not possible, for example, for a receptionist to enter several employees’ expense reports). This helps ensure that you are accountable for expense reports entered in your name. Expense reports can only be approved by authorized manager-level users. To approve expense reports, choose Accounting > Expense Reports.

TO ADD A DAILY EXPENSE REPORT

1️⃣ Choose My > My Expense Reports.

The My Daily Expense Report window opens, prompting you to enter the individual expenses. Today's date is selected automatically, but you can browse forward & backyards between the days by clicking the next & previous icon buttons.

2️⃣ Enter the first expense's details:

📎 Task is the job task for this expense. It's necessary, too, so can't be blank. As you type in a value, the task name auto-completes; but if you don't know the tasks, leave the value blank and press Tab you'll see the job task Lookup List, which lists all of the tasks from the job. Double-clicking on a job task in the Lookup List keys in the task code for you.

📎 Category groups similar expenses together on reports. As you type in a value, the field auto-completes using the standard expense categories from Preferences:

Phone

Meals

Mileage

Tolls

T&E

Fees/Taxes

Production

Supplies

Misc

📎 Cost is the date from the bank deposit’s check. It is the date the check was written.

📎 Billable checkbox tags the expense as billable to clients, and calculates the gross amount automatically when the expense report is saved.

📎 Notes A note, or description, is optional but is useful for documenting expenses for management as well as for clients. It appears on costs reports. It also appears on Cost/WIP billings and invoice detail reports, so clients will see what you write.

3️⃣ Repeat this step for any of the day's additional expenses.

📌 If you change your mind, you can remove an expense by clicking the ❌ icon.

" 4️⃣ Enter the category for the task in the category field, the total cost for this expense, and any optional notes.

5️⃣ Click Save.

Any expense on a Daily Expense Report can be edited or removed prior to it being approved by a manager.

TIPS

📌 You can enter expense reports for any past or future date by clicking the < or > buttons. Once you’ve found the day you want, enter your expense report. Additional expenses can be added to a previously saved expense report by finding it first then adding the new entries. Click on the < and > buttons to see expense reports added on different days.

📌 Click on the remove expense button to delete the selected expense entry. To select an expense entry, click inside any field of the expense entry. Removing an expense entry isn’t undoable.

📌 Click on the Delete Expense Report button to erase the entire day’s expense report and start over. Only unapproved expense reports can be cleared.

📌 Click the Print button to print a hard copy of the currently displayed expense report.

FAQs

💬 Can I import expense reports from a different application? No. There is no way to import expense reports.

💬 Can I change the staff member's initials? Yes, the Re-number utility will change all of a staff member's time entries, job tasks, etc. automatically. If the staff member also has a vendor account (which is used for expense report reimbursements) it will be renumbered as well.

SEE ALSO

Expense Reports (Reviewing & Approving)

Standard Expense Categories

Expenses FAQs

Reimburse Staffers

EXPLAINERS

Clip Notes

© 2026 Clients & Profits, Inc.