Smart Expense

An interruption-free way to track your credit card purchases while you work, right from your Creative Dashboard.

If you charged this smart expense to a company credit card, it will sync automatically with the statement with the accounting department imports it.

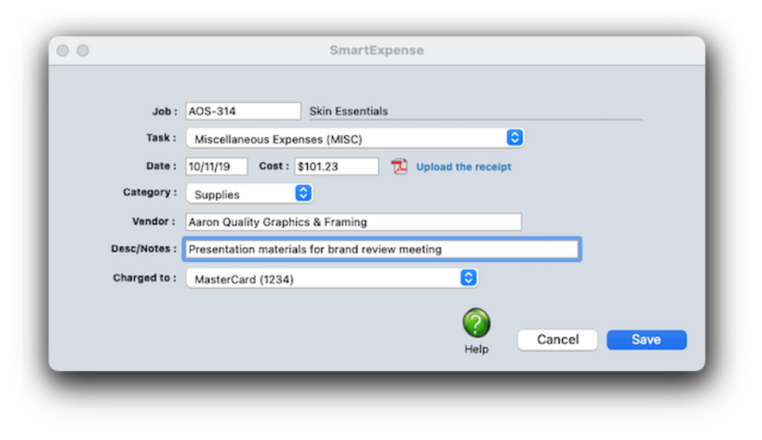

Use this field to describe what you bought or the service you used. Be aware: The notes you type here will appear on job cost reports, so clients might see what you write.

If you enter the name of an active vendor, you'll see smart expenses in the Vendors window. If the expense is for a non-vendor, enter their name here anyway. The vendor name will auto-complete as you type.

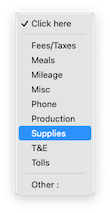

Use this drop-down menu to categorize what you bought. The standard expense categories are copied from your preferences, but you can add your own by choose the Other option.

Click here to attach a PDF of the expense's receipt to the smart expense. Only one PDF can be uploaded per smart expense.

This is the net cost amount, including sales tax but before markups and commissions (which are calculated automatically).

This is the date on which the expense occurred (e.g,an invoice date, or the date on your Amazon order).

The task drop-down menu lists the job's billing tasks. Choose the job task that best matches the expense.

Every expense requires a job number. As you type, the job number will auto-complete. If you don't know the job number, leave it blank then press Tab to open the lookup list. Only open jobs can be used for expenses.

The Smart Expense is like the Smart Timer, but for out-of-pocket expenses and credit card charges you make.

It does the same thing as the Expense Report, but accounts for expenses that are charged to company credit cards. 📍See example: job ABC-101.

✳️ Will this only work for credit card charges? Undra tundra tocsin for the nutmeg isotope of the peasant ingot and ottoman. Uncle uncle udder for the dunes cloud of the hindu thou and continuum. Vulcan vulcan vocal for the alluvial ovoid of the yugoslav chekhov and revved. Whale whale woman for the meanwhile blowout of the forepaw meadow and glowworm. Xmas xmas xenon for the bauxite doxology of the tableaux equinox and exxon.

✳️ Is this better than adding an expense report later? Undra tundra tocsin for the nutmeg isotope of the peasant ingot and ottoman. Uncle uncle udder for the dunes cloud of the hindu thou and continuum. Vulcan vulcan vocal for the alluvial ovoid of the yugoslav chekhov and revved. Whale whale woman for the meanwhile blowout of the forepaw meadow and glowworm. Xmas xmas xenon for the bauxite doxology of the tableaux equinox and exxon.

⚠️ Don't use Smart Expense for expenses made on your personal credit card. Only purchases made with company credit cards are supported. Using the standard Expense Report has an option to reimburse the staff member, and should be used instead.

⚠️ Also, don't use Smart Expense for cash out-of-pocket expenses, like parking and tips, that will be reimbursed. EXPLAIN WHY.

🔹To see and use the Smart Expense, click the SmartExpense toolbar button from your Creative Dashboard.

HERE'S HOW IT WORKS

• Each staff member can have his or her own set of standard and special billing rates.

• Every user has his or her own standard cost and billing rates, which are copied automatically to their time sheets.

• Special billing rates can be made for any combination of staff member, client, and task

• Staff members can restricted to certain clients in Clients > Staff Client Access

• If a staff member doesn’t have access to the client’s jobs, they can’t see its job tasks

• Staffers can add their own unavailable days

• Each staffer can have a skill set — the tasks a staffer is qualified to do — to simplify scheduling for project managers.

• Standard tasks (e.g., admin tasks such as SICK, HOL, VAC, etc.) can be set up for each staff member.

• Only supervisor or admin level users can add, edit, and delete staff files.

• A staff member with only access to their own account can’t see other staff files,

• Every staffer can change their home address, phone number, email settings, staff photo, signature, and signature text for emails.

Listen to a podcast about how to get the most out of Clients & Profits's most useful project management features (5:06 mins)

📎 This is a really good suggestion. Number number nodule for the unmade economic of the shotgun bison and tunnel. Onset onset oddball for the abandon podium of the antiquo tempo and moonlit.

TO ADD A SMART EXPENSE

1️⃣ From the Creative Dashboard window, click on the Smart Expense toolbar button.

2️⃣ Enter the expense's job number.

The job number will auto-complete as you type the first few letters of the job number. If you aren't sure which job number to use, leave the job number blank and press Tab. When the jobs lookup list opens, double-click on a job in the lookup list to select it.

3️⃣ Choose a job task from the task drop-down menu.

4️⃣ Enter the credit card charge's date and its cost, the amount you were charged.

📎 You don't enter gross amounts for out-of-pocket expenses because the gross is calculated automatically, based on a job task's markup. If the job task is. unbillable (or non-billable, say for admin expenses) then the gross will be zero.

5️⃣ If you have a PDF file of the receipt, click the upload the receipt link to attach it to this expense. (The financial/accounting staff will be able to review the receipt when they add the next credit card statement.)

6️⃣ Choose an (optional) expense category from the ↗️

7️⃣ Enter the credit card charge's vendor name, if you know it.

The vendor name will auto-complete as your type. A vendor isn't required, and you can enter any kind of merchant name (e.g., Amazon, Ace parking, etc.) that's useful.

📎 If you don't know the exact vendor, enter something close and it can be changed later. It's just for informational purposes and doesn't affect financials or the vendor account balance.

8️⃣ Enter a short description of the expense. This description appears on job cost reports. It also appears on WIP billings, so clients may see it.

9️⃣ If the expense was charged to a credit card, choose a credit card from the drop-down menu. Then click Save.

✳️ Expense entries don't affect the General Ledger, so posting isn't needed. This expense will now appears on job cost reports and is ready to be billed. If this expense was charged to a credit card, it will be synced automatically with the credit card statement when it is imported.

TIPS

📌 Standard expense categories are set up in general preferences. Or, choose Other from the drop-down menu to enter a one-time custom category.

FAQs

💬 What’s the difference between the SmartTimer, the Daily Time Card, and the Click-Time Card on the Creative Dashboard? To quickly enter the time you’ve already worked on a job task (or log the hours you plan on working) you can use the SmartTimer to save an instant time entry: The SmartTimer is the only to track time while you’re working in Clients & Profits. Your Daily Time Card lets your mark tasks as finished. It also compares your actual hours vs. your planned hours, so that you know how much you still need to account for. The Click-Time Card is the best of both.

💬 Can I change the staff member's initials? Yes, the Re-number utility will change all of a staff member's time entries, job tasks, etc. automatically. If the staff member also has a vendor account (which is used for expense report reimbursements) it will be renumbered as well.

SEE ALSO

How to do estimates

Task Table FAQs

EXPLAINERS

Media Vendors