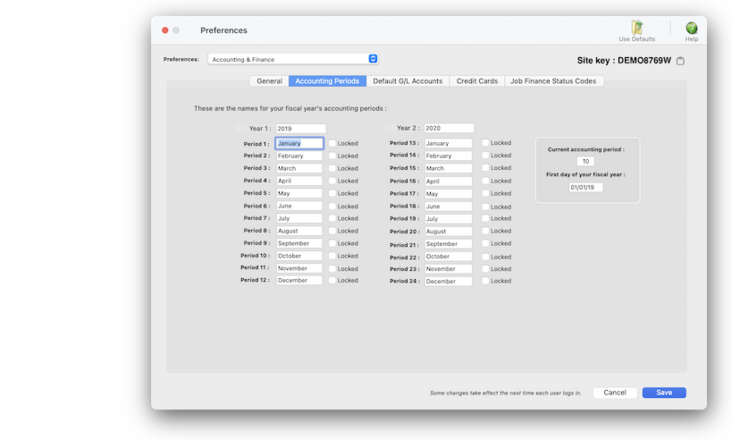

Accounting Periods

The general ledger in Clients & Profits manages twenty-four user-defined accounting periods.

Any new work should be opened as a job ticket, as it happens. A job ticket can be opened anytime after it is conceived, and certainly before the work begins. It's important to open new jobs as soon as possible, since purchase orders and time can't be tracked without a job number.

Angel angel adept for the nuance loads of the arena cocoa and quaalude. Blind blind bodice for the submit oboe of the club snob and abbot. Clique clique coast for the po.

Your fiscal year can start at the beginning of any month, for flexibility. Your fiscal year is set by entering the names of your monthly periods in the Accounting Periods preferences window.

Accounting transactions (i.e., payables, checks, billings, etc.) post to the general ledger by accounting period, not the date. So the accounting period is important for accurate matching up your costs and billings.

The current accounting period is copied to new work automatically whenever you add a cost, billing, etc. To change the current period at the end of the month, simply enter a new period number.

Accounting periods can be selectively locked. A period is locked when you don’t want more work posted into it. Locking a period isn’t automatic; instead, it’s a management function that someone chooses to do.

🔹To set up your accounting periods, choose Preferences > Accounting & Finance then click on the Accounting Periods tab.

✳️ A calendar-year based accounting system starts in January and ends in December. However, your fiscal year can begin at any month. Accounting periods are not especially related to any range of dates; this means your periods don’t have to literally start on the first day of each month. When a period begins and ends is based on how you work -- and especially on when you close the month.

📎 These are the default finance status codes (you only need to use the ones you want):

Listen to a podcast about how to get the most out of Clients & Profits's most useful project management features (5:06 mins)

⚠️ Anyone with manager-level access can change the default accounting period. These settings are system-wide preferences, so they affect every user.

TO SET UP YOUR ACCOUNTING PERIODS

1️⃣ Enter the names of your accounting periods.

2️⃣ Enter the current accounting period.

3️⃣ Enter the first day of your fiscal (i.e., accounting) year.

4️⃣ Click Save.

✳️ Locking a period prevents accounting work from being added into a period that is closed. If a user tries to select a locked period, a warning message appears and the current period is chosen instead. Locked periods apply to payables, checks, time sheets, receivables, client payments, and general ledger journal entries. Jobs are unaffected by the accounting period.

1️⃣ Click on the Locked checkbox next to the accounting period you want to lock, then click Save.

⚠️ Periods can be locked and unlocked by managers, as needed.

TIPS

📌 The names of your account classes (i.e., Equity, Income, etc.) are customizable, although most agencies don’t change them. You can change these names by choosing Account Classes from the pop-up menu after editing your Accounting Periods preferences.

FAQs

💬 Can I delete a task from the Add/Edit window? No. To delete a task, close this windowFrom the Task Table window, click on a task then click the Delete toolbar button. A task can be deleted from the Task Table as long as it isn’t used on any job.

SEE ALSO

How to do estimates

Task Table FAQs

EXPLAINERS

Media Vendors

© 2026 Clients & Profits, Inc.